- Bitcoin’s 30-day correlation with Nasdaq hits 0.80, highest since 2022.

- Crypto market lost $1.1 trillion in 41 days, says data.

- BTC dropped 25% in one month despite new all-time highs earlier.

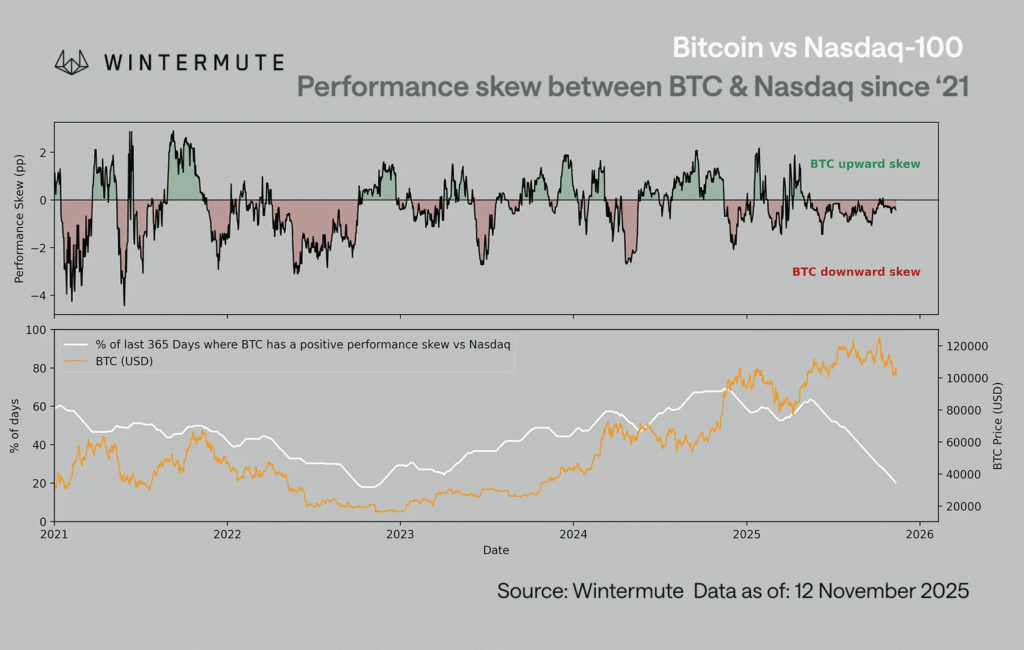

Bitcoin’s recent trading pattern shows stronger downside reactions to stock market declines, while its upside response remains weak. Wintermute and The Kobeissi Letter both reported that the asset is still heavily correlated with the Nasdaq 100, reaching its second-highest level in a decade.

However, this correlation now carries a downside bias, creating concerns about Bitcoin’s current role in risk-driven markets. This change comes as Bitcoin trades 25% below its peak and the broader crypto market sheds over $1.1 trillion in value.

Bitcoin Follows Nasdaq Drops but Misses Stock Market Gains

Recent market data shows Bitcoin’s 30-day correlation with the Nasdaq 100 Index has reached 0.80, according to The Kobeissi Letter. This is the second-highest level recorded in the past ten years and marks a return to 2022 levels.

Wintermute’s latest analysis says that while the correlation remains strong, it now leans bearish. This means Bitcoin tends to fall more sharply when equities decline and recovers less during equity rallies. Wintermute explains that this pattern often shows up near market bottoms, not near peaks.

Over the last five years, Bitcoin generally followed tech stock movements. But since late 2023, the behavior shifted, with BTC underperforming even during risk-on conditions. The crypto has lost 25% in value over the past month and is now trading under $95,000.

Crypto Liquidity Stalls as Traditional Markets Lead

Wintermute attributed this shift to two key forces. One is a shift in investor attention toward mega-cap tech stocks, which have absorbed the majority of risk-on capital. This reduces crypto’s ability to benefit when market sentiment turns optimistic.

Jasper De Maere from Wintermute added, “This crowding of mindshare means BTC remains correlated when global risk sentiment turns, but doesn’t benefit proportionally when optimism returns.”

The second factor is the current state of liquidity in the crypto market. The firm notes that stablecoin supply has stalled, ETF inflows have slowed, and exchange order books remain thin. These issues weaken Bitcoin’s price support and increase the depth of losses when selling begins.

The Kobeissi Letter pointed out that U.S. stock futures remained unaffected even after crypto lost $100 billion over the weekend. They noted, “US stock market futures just opened and they are completely unfazed by the crypto decline this weekend.”

Bitcoin Loses Safe Haven Status Amid Market Uncertainty

Bitcoin’s five-year correlation with the Nasdaq now stands at 0.54. The Kobeissi Letter reported that Bitcoin shows almost no correlation with gold or other traditional safe-haven assets.

In fact, gold has outperformed Bitcoin by 25 percentage points since October. The post labeled the current crypto market conditions as a “leverage and liquidation-based bear market.”

This new data raises concerns about Bitcoin’s status as a hedge. With high downside beta and weak upside response, Bitcoin is now trading more like a leveraged tech stock than a stable digital store of value.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.