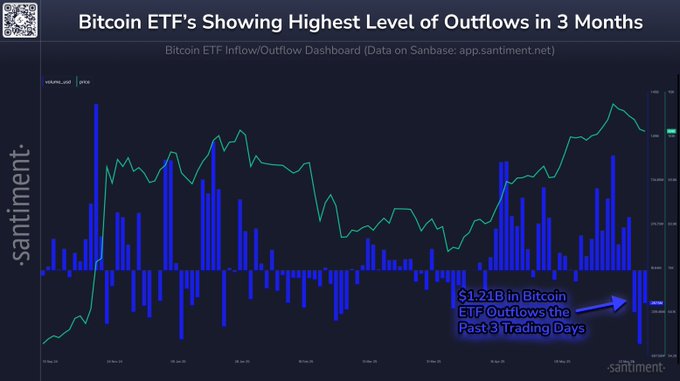

Bitcoin ETFs have recorded a total of $1.21 billion in net outflows, the highest amount in the past three months.

Bitcoin ETFs entered the market in early 2024 as the next phase of mainstream crypto adoption. They have allowed traditional investors with little or no knowledge of crypto to gain exposure to bitcoin without having to hold private keys. With various conventional asset managers offering ETFs, they have become increasingly popular, particularly with large capital investments.

Bitcoin has crossed the $100k mark, with the price fluctuating around $105K, at press time, per CoinMarketCap. However, recent ETF outflows have raised red flags in the market. According to Santiment data, a total of $1.21 billion has exited BTC ETFs within a three-day trading period. This is the largest outflow since the second week of March, 2025.

What’s fueling BTC ETFs’ Outflow?

With Bitcoin’s price surging to new all-time highs, the recent ETF outflow could be a warning of possible price volatility ahead and signal investor caution. Additionally, this could mean profit taking as institutions take advantage of the recent price surge.

The United States federal economic and inflation policies could be influencing macroeconomic activity among institutional investors. Investors could be repositioning their exposure to risky assets, including crypto, minimizing losses associated with price volatilities.