- U.S. spot Bitcoin ETFs saw $471M in single-day outflows this week.

- Ethereum ETFs recorded $81.44M in outflows with limited new inflows.

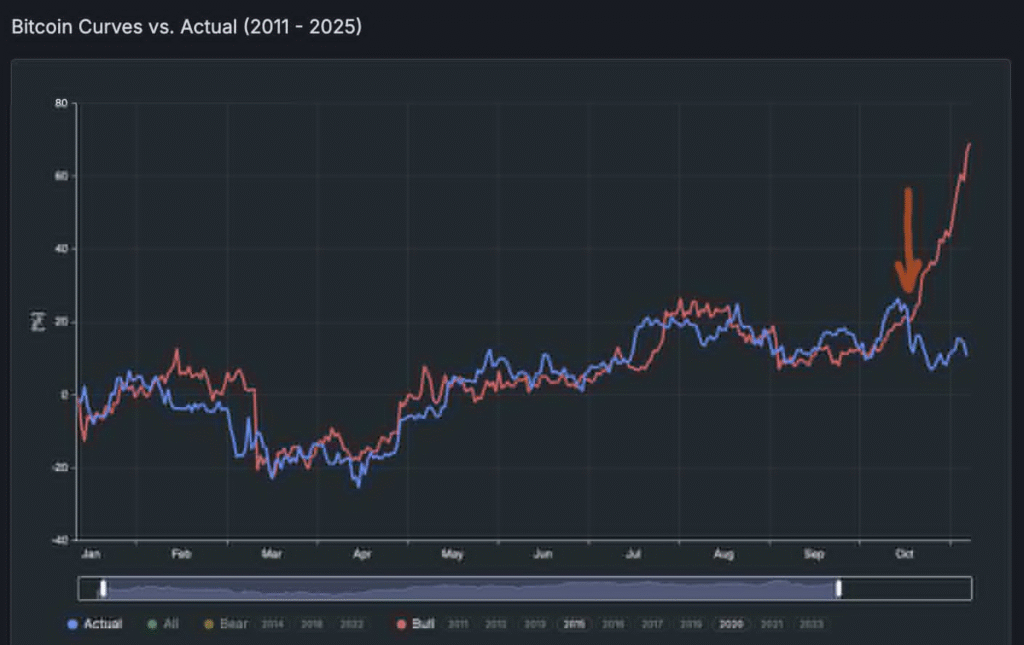

- Analyst Jason Pizzino says Bitcoin’s price is diverging from its cycle model.

U.S. spot Bitcoin exchange-traded funds (ETFs) recorded a combined net outflow of $471 million on October 29, marking one of the largest single-day withdrawals since their launch earlier this year. No ETF issuer reported inflows during the session, indicating renewed investor caution after months of moderate accumulation.

According to Glassnode data, U.S. spot Bitcoin ETFs experienced a net outflow of $93 million the following day, suggesting that sell pressure among traditional finance investors remains elevated. Analysts view the movement as part of a broader cooling trend in institutional exposure to digital assets.

Meanwhile, Ethereum-linked ETFs faced a similar pattern. The sector registered $81.44 million in total outflows, with only BlackRock’s ETHA showing modest inflows. The overall reduction reflects weaker short-term conviction after a volatile trading period across major cryptocurrencies.

Analysts Warn of Market Cycle Divergence

Market analyst Jason Pizzino stated that Bitcoin’s current cycle is exhibiting signs of deviation from historical patterns. His comparative model, titled Bitcoin Curves vs. Actual (2011–2025), shows that the asset’s price has flattened since September, while its historical 5- and 10-year cycle composites continue to trend higher.

Pizzino noted that earlier this year Bitcoin’s movement closely followed previous cycle averages. However, the recent divergence suggests that the asset may not be replicating the strong upward momentum usually observed during this phase of the cycle.

Demand Recovery Slower Than Past Bull Phases

Glassnode noted that inflows into spot Bitcoin ETFs have remained below 1,000 BTC per day. This level is notably lower than the 2,500 BTC daily inflows seen at the start of earlier rallies. Although demand is showing signs of a gradual recovery, it has yet to reach the levels typically associated with major bullish expansions.

Analysts suggest that institutional positioning remains cautious amid global economic uncertainty and shifting risk sentiment. While long-term holders continue to maintain their exposure, short-term ETF flows indicate subdued market enthusiasm compared to earlier in the year.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.