- Massive BTC inflows signal whales may be preparing to sell soon.

- Increased Bitcoin reserves on exchanges point to rising sell pressure.

- Economic factors like inflation are adding to Bitcoin’s market struggles.

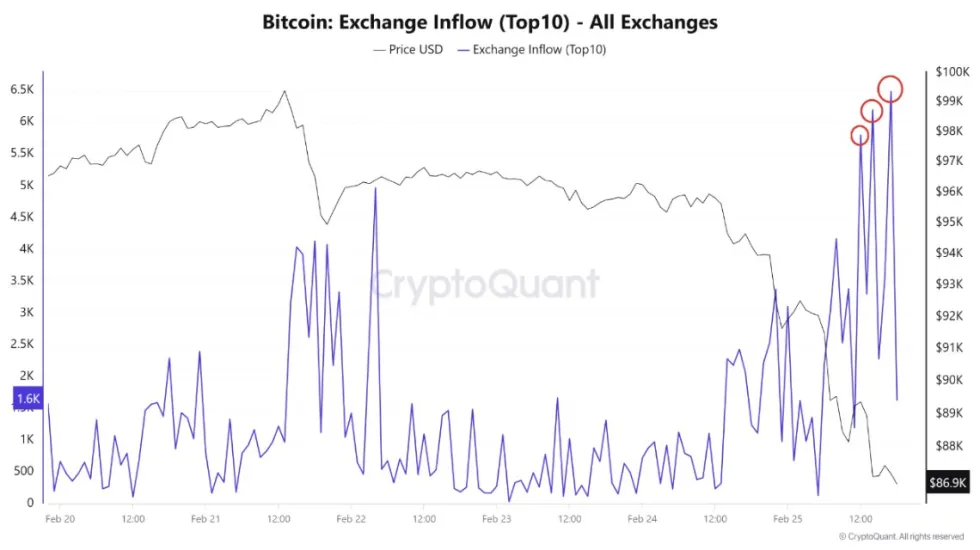

Bitcoin has entered bearish territory following a dramatic $10,000 price drop in just two days. The sharp decline has raised concerns about growing sell pressure, particularly as large volumes of BTC continue flowing into crypto exchanges. Recent data from CryptoQuant highlights that 6,779 BTC, worth around $573.6 million, was deposited into exchanges within an hour. This massive influx of Bitcoin has raised speculations that large investors, or “whales,” might be preparing to sell, increasing downward pressure on Bitcoin’s price.

Exchange Inflows Signal Growing Sell Pressure

Bitcoin’s recent surge in exchange inflows is alarming. Over 5,000 BTC was deposited into the top 10 exchanges in one day, signaling that major holders may be positioning themselves for sell-offs. Historically, such inflows have often preceded increased market volatility, suggesting that the cryptocurrency may experience additional price fluctuations shortly.

In addition, Bitcoin’s reserves on Binance have increased significantly, which typically signals heightened selling pressure. As more Bitcoin becomes available for trade, the risk of a price drop rises if demand fails to absorb the new supply. If this trend continues, traders could face heightened volatility and further declines in Bitcoin’s price.

Bitcoin’s Exchange Inflows Reach Alarming Levels

Market analyst Amr Taha recently pointed out the sharp rise in Bitcoin Exchange Inflow (Top 10), a key metric tracking large BTC deposits into exchanges. Taha suggests that these substantial transfers indicate a shift in investor sentiment, with large holders preparing to offload their positions amid growing uncertainty.

CryptoQuant’s data also shows that Bitcoin inflows have become more volatile as prices fell to $86,900. Large investors may be taking profits or engaging in panic selling, which is putting more pressure on Bitcoin’s price. The ongoing trend of rising inflows suggests that Bitcoin’s recovery could face further delays. Bitcoin trades at $84,711, marking a 6% drop in 24 hours.

Macroeconomic Factors Add to Bitcoin’s Struggles

Beyond exchange inflows, broader economic factors contribute to Bitcoin’s recent decline. The U.S. Consumer Confidence report showed a sharp drop to an eight-month low, reflecting growing concerns about inflation and financial instability.

According to BBC News, recent tariffs imposed by the Trump administration, including a 10% universal tariff and up to 60% tariffs on Chinese goods, have raised concerns about rising business costs. These increased costs could impact consumer spending and overall investor sentiment, indirectly affecting the performance of risk assets like Bitcoin.

What’s Next for Bitcoin?

With rising exchange inflows and broader economic concerns, Bitcoin could face more volatility in the short term. If large holders continue moving BTC to exchanges, this will likely increase sell pressure and weigh the price. However, not all inflows may be related to selling. Some could be custodial transfers, OTC trades, or internal exchange transactions that don’t directly affect market prices.

As traders continue to monitor on-chain data and economic trends, Bitcoin’s short-term outlook remains uncertain. Bitcoin may struggle to regain upward momentum anytime soon if the current sell pressure persists.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.