- Historic Weakness Persists – Bitcoin’s September track record shows 10 of the past 15 years closed negatively, reinforcing seasonal pressure.

- Technical Signals Diverge – The MACD indicates lingering bearishness, but narrowing gaps suggest fading selling momentum and possible reversal.

- Momentum Builds at $116K – Strong Aroon Up and heavy trading volume point to renewed buying strength and potential for a rally.

Bitcoin entered September under seasonal pressure as historical data showed the month often ends with losses. Over the past 15 years, 10 Septembers closed negatively, giving the month a reputation for weakness. Only five years recorded gains, making the probability of a positive September in 2025 about 33 percent.

This pattern has shaped market expectations, often reinforcing selling pressure during September. Traders anticipate negative outcomes based on past frequency, creating self-reinforcing behavior. Therefore, September continues to stand out as a difficult month for Bitcoin performance.

The 2025 data shows some resilience in early September compared to prior years. The trend has been less negative, but history still weighs heavily. As the month progresses, gains remain vulnerable to reversal.

Current Market Position

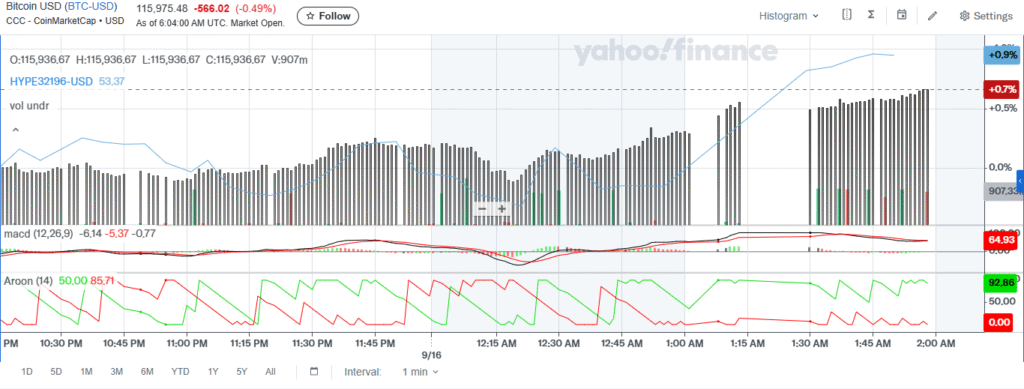

Bitcoin traded at $115,975, recording a decline of 0.49 percent at the time of analysis. The market displayed strong intraday activity with heavy volume spikes. Price action consolidated tightly around the $116,000 level, reflecting uncertainty about the next directional move.

Source: Yahoofinance

Technical signals reflected both risk and opportunity. The MACD indicator remained negative, with the line below the signal and the histogram also in red territory. However, the gap between MACD and signal line narrowed, hinting at weakening bearish pressure.

Momentum indicators painted a mixed picture. While MACD suggested continued bearishness, volume data revealed strong participation, particularly during late-night sessions. This combination highlighted a market in transition, balancing pressure with potential recovery.

Signals of Momentum

The Aroon indicator displayed stronger bullish signs. Aroon Up stood at 92.86, while Aroon Down dropped to zero. This suggested buyers reasserted control and signaled possible upward momentum.

Volume patterns supported this interpretation. Renewed buying absorbed short-term retracements, strengthening the case for a potential push higher. Market participants appeared engaged, providing fuel for possible gains.

Finally, Bitcoin started the month of September with a historical weakness, but displayed a technical strength. With the volume still supporting the price of above $116,000, the possibility of a rise is enhanced. But any inability to hold this potentially will cause a new selling wave in the last week of the month.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.