The cryptocurrency market is buzzing following a detailed analysis from trader Axel Adler Jr. (@AxelAdlerJr) on X, highlighting a significant shift in Bitcoin futures position dominance.

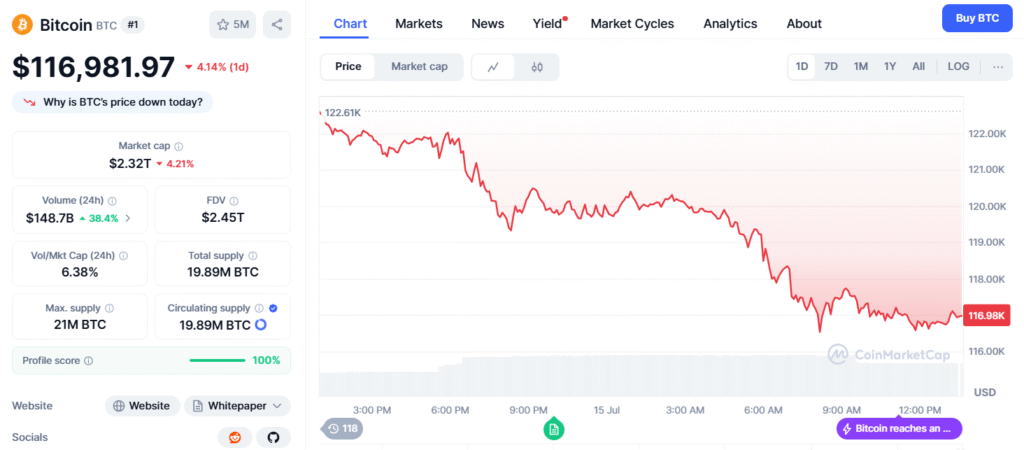

Posted earlier today, the chart reveals a sharp decline in bull dominance and a negative long-to-short ratio after Bitcoin hit an all-time high (ATH) near $117K. This comes as Bitcoin’s market cap dominance slipped from 58% to 54% amid a recent altcoin rally, according to CoinMarketCap data, signaling a potential redistribution of investor interest.

Adler’s analysis points to aggressive shorting by bears post-ATH, a move that aligns with findings from a 2023 Journal of Financial Economics study linking high short interest to price corrections in volatile assets like Bitcoin. This bearish sentiment suggests the $117K level is a critical support zone for bulls to defend. A breach could trigger further declines, while a hold might signal a reversal.

Adding context, Crypto Wall Street (@CryptoWallSt_) replied with insights into a positive funding rate and stable open interest, hinting that the recent drop may stem from spot market profit-taking rather than a broad market collapse. Late long liquidations and new long entries from other participants could be driving this volatility, a scenario supported by Coindcx.com’s 2024 guide on funding rate correlations with Bitcoin prices, which underscores their role in market sentiment.

As, the market remains on edge. The interplay of futures dominance, funding rates, and spot activity suggests a complex battle between bulls and bears. Investors are advised to monitor the $117K support closely, with potential implications for both Bitcoin and altcoins. Historical volatility, as noted in a 2020 Financial Innovation study, indicates that such shifts often precede significant market moves, making this a pivotal moment for traders.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.