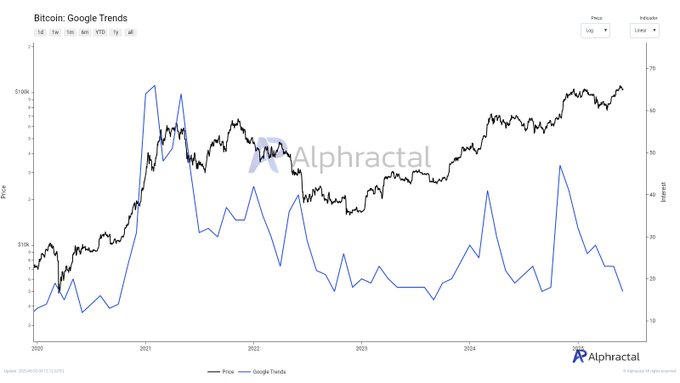

Bitcoin has crossed the psychological $100k mark, but its Google search interest remains low, suggesting potential volatility ahead.

Google Trends is significant in measuring the public interest and retail sentiment by recording the rate of search for terms like “Bitcoin” over time. Bitcoin Google Trends hit 100 points in 2018.

As of press time, Bitcoin is trading at $105,289 with an 8.76% increase in trading volume, per CoinMarketCap. The King of crypto recorded 17 points when the price was at $54k in September 2024 and $26k in August 2023. Despite crossing the anticipated $100k mark, Bitcoin’s Google searches are still at 17.

According to Alphractal data, Google Trends has remained relatively low, showing no spikes in relation to price upsurge past the psychological $100k mark.

So, what does this mean for BTC?

The lack of spikes in Bitcoin Google searches amid its all-time highs could mean low emotional and financial investment by retail investors. Lately, BTC ETFs have gained popularity as traditional investors step into the digital assets investment.

With Large institutions rushing to acquire BTC for strategic reserves, the current rally could be fueled by institutional demand as retail curiosity remains sidelined. This equates to low retail hype and thus low Google searches.

As unusually low search interest prevails at BTC ATHs, the lack of retail participation could mean sharp volatility ahead while the market seeks new triggers. So, does this mean a calm before a storm? Investors are watching for whale activity and major market fundamentals that could trigger such volatility.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.