- BTC recovers from $80,600 to $91,897 amid 85% odds of Fed rate cut in December.

- November saw $3.48B in Bitcoin ETF outflows, second-highest on record.

- BlackRock’s IBIT led ETF inflows, contributing over $125 million in two days.

Bitcoin (BTC) rebounded from last week’s dip to around $80,000 and is now trading near $91,639. The digital asset rose to an intraday high of $91,897, driven by improved sentiment and expectations of lower interest rates in the U.S.

Despite the price rebound, trading volume dropped by over 32% to $49 billion, suggesting a pause in activity following recent volatility. Experts said this pattern is common after a sharp move and may indicate consolidation ahead of a possible breakout.

The market regained momentum due to growing expectations of a Federal Reserve interest rate cut. Current estimates suggest an 85% chance of a rate cut in December. Lower rates tend to support risk-based assets such as Bitcoin by encouraging more liquidity in markets.

ETF Activity and Institutional Sentiment Show Mixed Signals

November was challenging for Bitcoin ETFs, with total net outflows reaching $3.48 billion. This marked the second-highest withdrawal month since their inception, following February’s $3.56 billion. Two separate days in November also recorded some of the largest single-day outflows.

The shift in sentiment led many investors to exit ETFs, seeking stability in less volatile assets. However, the trend reversed slightly in late November as U.S. Spot Bitcoin ETFs registered net inflows over two consecutive days. Total inflows hit approximately $150 million, with BlackRock’s IBIT contributing over $125 million.

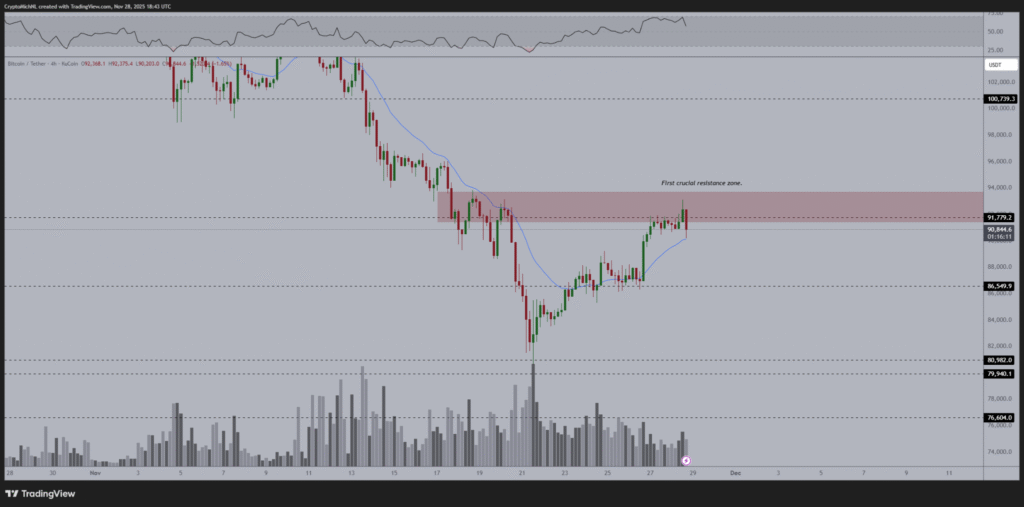

Market analyst Michaël van de Poppe pointed out that Bitcoin is testing a key resistance level and needs to break above it to confirm further upward momentum. He added that holding above the 20-Monthly Moving Average would support bullish continuation.

Analysts Set Key Levels Amid Holiday Season Optimism

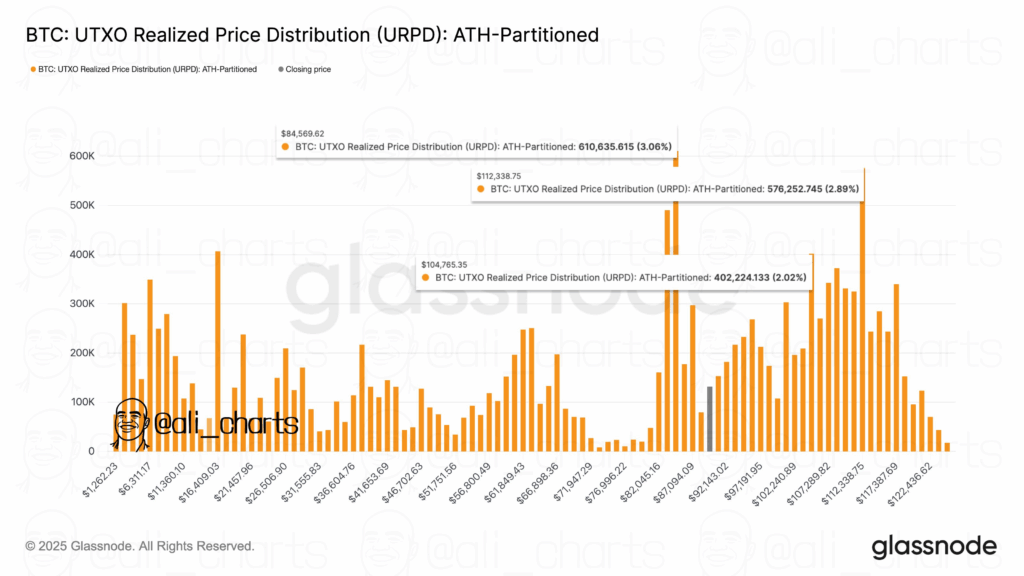

Ali Martinez identified $112,340 as the upper resistance or “ceiling” level to watch based on the UTXO Realized Price Distribution chart. He also marked $84,570 as the key support that Bitcoin must hold to avoid another decline.

Historical trends from CoinGlass show that December often brings positive returns for Bitcoin. This seasonal performance, combined with renewed ETF inflows and macroeconomic factors, could continue supporting Bitcoin’s upward movement into year-end.

Bitcoin’s ability to sustain above current resistance will remain a focus for investors in the days ahead, especially as market participants await the Fed’s next policy move.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.