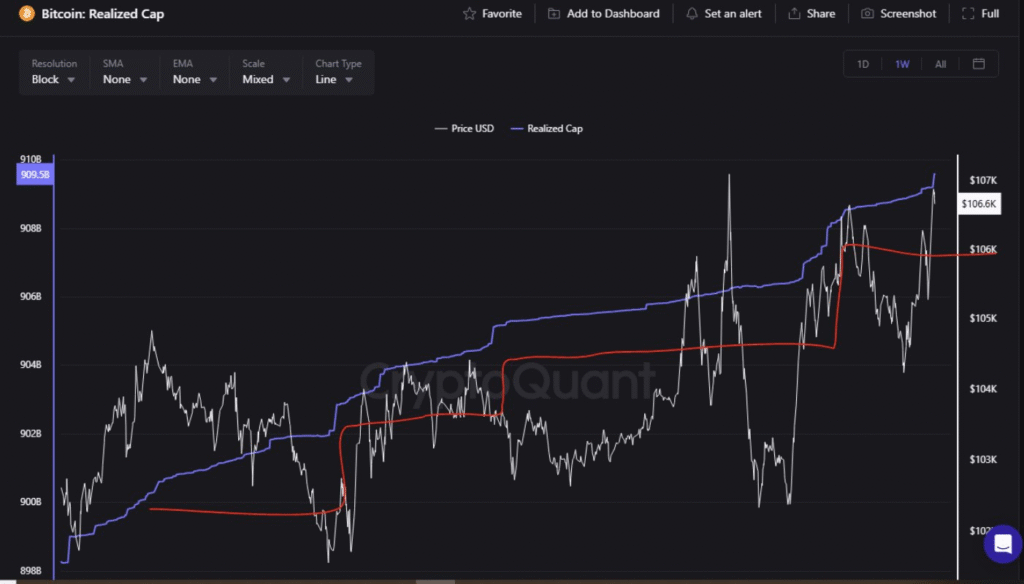

Bitcoin’s Realized Capitalization jumped by a staggering $3 billion within a single day, marking a 0.33% increase and signaling strong market accumulation, according to data shared by CryptoQuant. The surge suggests a wave of new capital entering the market, reinforcing bullish sentiment among investors.

Realized Capitalization, as defined by on-chain analytics platform ChainExposed, measures the total USD value of all Bitcoin at the price each unit was last transacted. This metric differs from traditional Market Capitalization, which multiplies the current price by the total supply. Realized Cap offers a clearer picture of the collective cost basis of Bitcoin holders, making it a valuable indicator of investor behavior.

On-chain analyst @oro_crypto highlighted the significance of this uptick, interpreting it as a sign of renewed confidence in the asset. “This type of accumulation reflects strategic positioning by investors expecting future price appreciation,” the analyst noted.

This activity aligns with historical Bitcoin market cycles, particularly those tied to the asset’s quadrennial halving events. Each halving has historically preceded major bull markets, as the reduced supply issuance often creates supply-demand imbalances.

Investment firm Caleb & Brown echoed this sentiment, noting that such accumulation often occurs during perceived periods of undervaluation. “Forward-looking investors typically take advantage of these windows, positioning themselves ahead of broader market rallies,” the firm stated.

With Bitcoin recently undergoing another halving, analysts suggest this surge in Realized Capitalization could mark the early stages of a new bullish phase. As capital continues to flow into the market, all eyes remain on whether history will once again repeat itself.

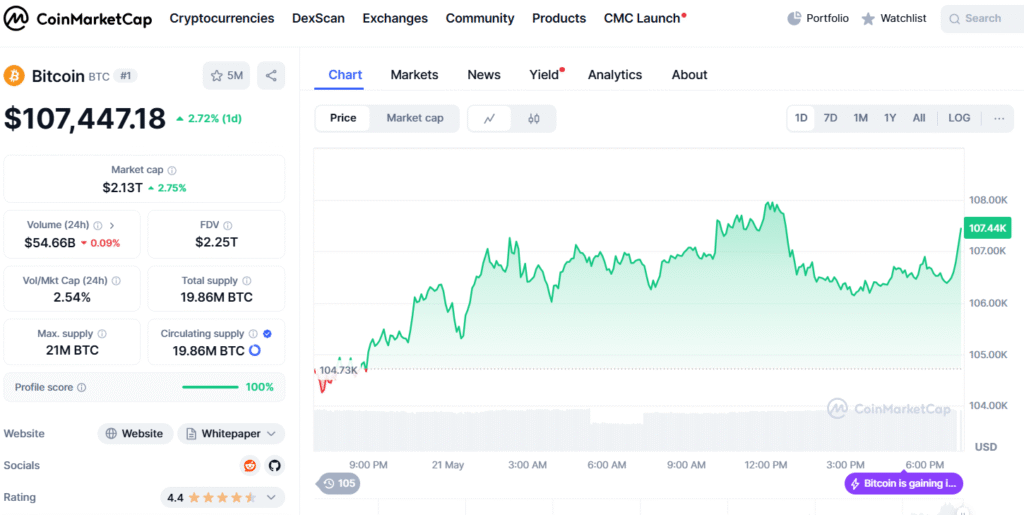

At the time of writing, Bitcoin trades around around $107k, marking a 2.71% increase in the last 24 hours.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.