- Long-term holders moved 97000 BTC on August 29 the largest daily volume this year

- Nearly 70 percent of the selling came from coins held between one and five years

- Satsuma Technology raised its Bitcoin treasury to 1148 BTC despite market volatility

Bitcoin’s long term holders have increased spending activity, with recent data showing a stronger release of coins. Glassnode reported that on August 29, about 97,000 BTC were moved, the largest daily total of 2025. The movement came as Bitcoin traded below $110,000, creating selling pressure in the market.

Coins held between one and five years made up around 70 percent of the total moved that day. The 14-day simple moving average also shows that long term holder activity has been rising steadily. However, current levels remain well below the spikes seen in late 2024 when selling volumes surged to cycle highs.

Despite the increased outflows, Glassnode noted that the market structure remains within normal cycle ranges. The data suggests that long term holders are selling but not at extreme levels. Bitcoin has since stabilized, trading at $108,068 with a modest 0.37 percent gain on the 4-hour chart.

Institutions Expand Treasuries

While long term holders have been more active sellers, institutional players have continued to increase their Bitcoin positions. Sweden’s Goobit Group AB confirmed that it added 1.0197 BTC through a purchase following its recent share issue. This brought the company’s total holdings to 11.6491 BTC, valued at about $1.25 million.

Satsuma Technology also disclosed that it added 22.65 BTC since its last update, raising its total to 1,148.65 BTC. These acquisitions reflect ongoing corporate interest in adding Bitcoin reserves even during periods of volatility.

Market Structure and Price Levels

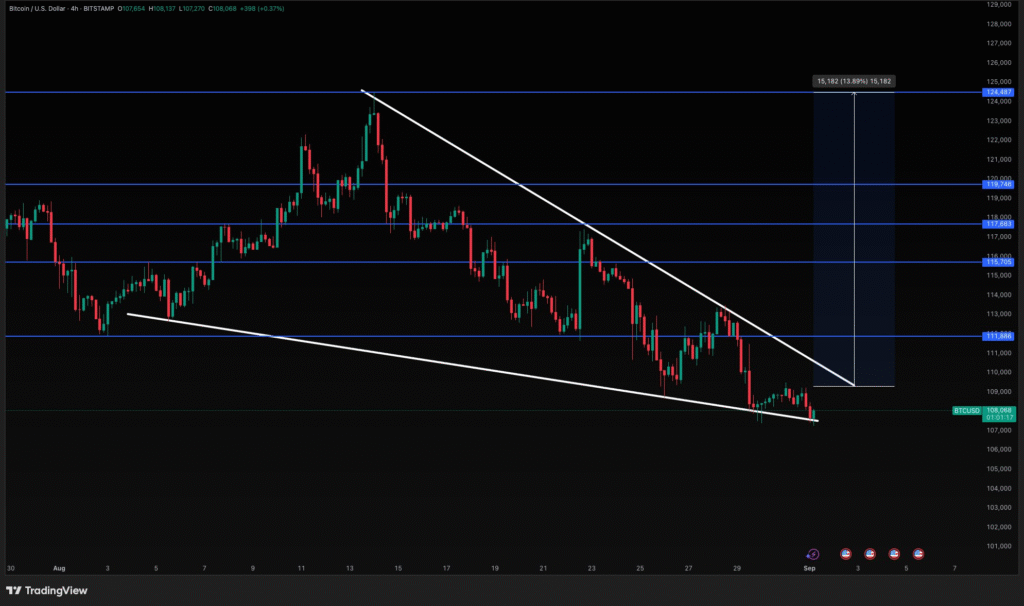

Bitcoin is consolidating within a descending wedge pattern after recent moves below key support. Analysts note strong support near $107,000 while resistance levels are marked at $111,888, $116,705, and $119,746. A breakout above resistance could target $124,487, which represents a possible 13.89 percent upside.

The chart suggests that Bitcoin is approaching a decision point, with either a breakout or further consolidation likely in the near term. For now, the balance between long term holder selling and institutional buying continues to shape the market environment.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.