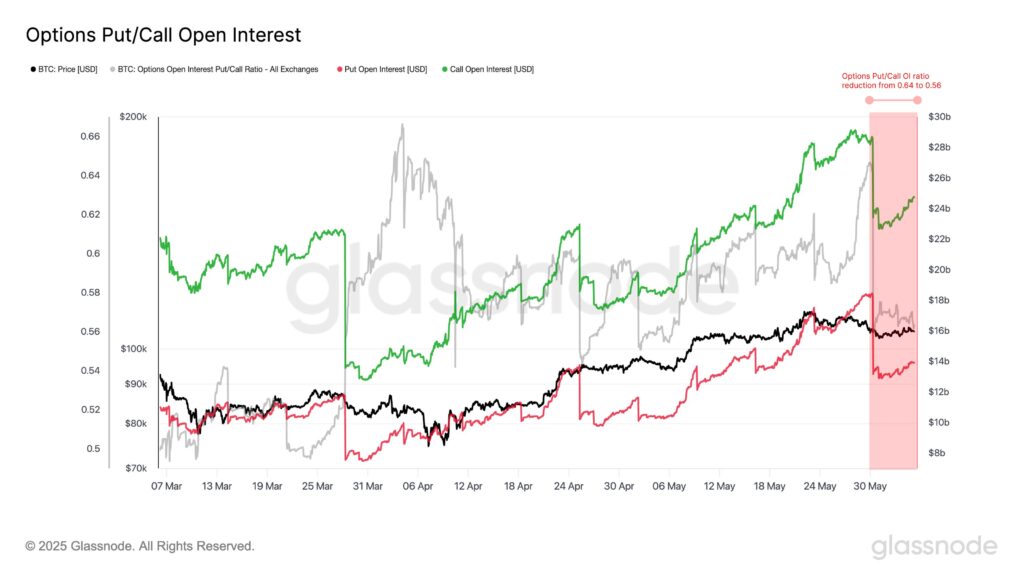

The Options Put/Call Open interest has dropped from 0.64 to 0.56, suggesting a reduced investor conviction in the market.

Put/Call Open Interest Ratio is a significant metric that allows comparison of outstanding market put options to call options. Traders employ this metric to understand market sentiment, the strength behind prices, and identify potential reversals.

Recent data from Glassnode has revealed a fading momentum, with options data showing a drop in open interest on the BTC put/call. Call open interest dropped from $28.7B to $24.7B, while put open interest dropped from $18.4B to $ 13.9 B. This has brought the Put/Call ratio down from 0.64 to 0.56.

Despite call-heavy positioning by traders in the market, a sharp reduction in both put and call positions suggests a weakening trader conviction. The prevailing sentiment is associated with Bitcoin’s sideways ranging price that fails to break out decisively after the recent upsurge to new ATHs.

Investors could be anticipating macroeconomic market catalysts that minimize volatility and create thinner volumes. Traders are making cautious moves while waiting for clear, confirmed breakouts. This signals a lower confidence in the short-term BTC directional movements, even though most of the investors are still bullish in the long term.