- Bitcoin options OI is now approaching parity with futures OI across exchanges.

- A key CME gap near $107K has been filled as expected by traders.

- Options flows are gaining more influence over Bitcoin price than futures liquidations.

Bitcoin’s Options Open Interest has risen rapidly in recent months. Glassnode data indicate that by late 2025, the level of Futures Open Interest will be approached for the first time, suggesting a shift in market preferences.

This rise points to growing use of defined-risk strategies and a focus on volatility rather than leveraged futures positions. Options trading allows traders to manage downside risk while gaining exposure to price movements.

The increase in Options OI, especially during high-volatility periods, suggests that traders are adjusting to more controlled risk-taking approaches. According to Glassnode, options flows are now becoming a more dominant force in shaping Bitcoin’s price movement than futures-driven liquidations.

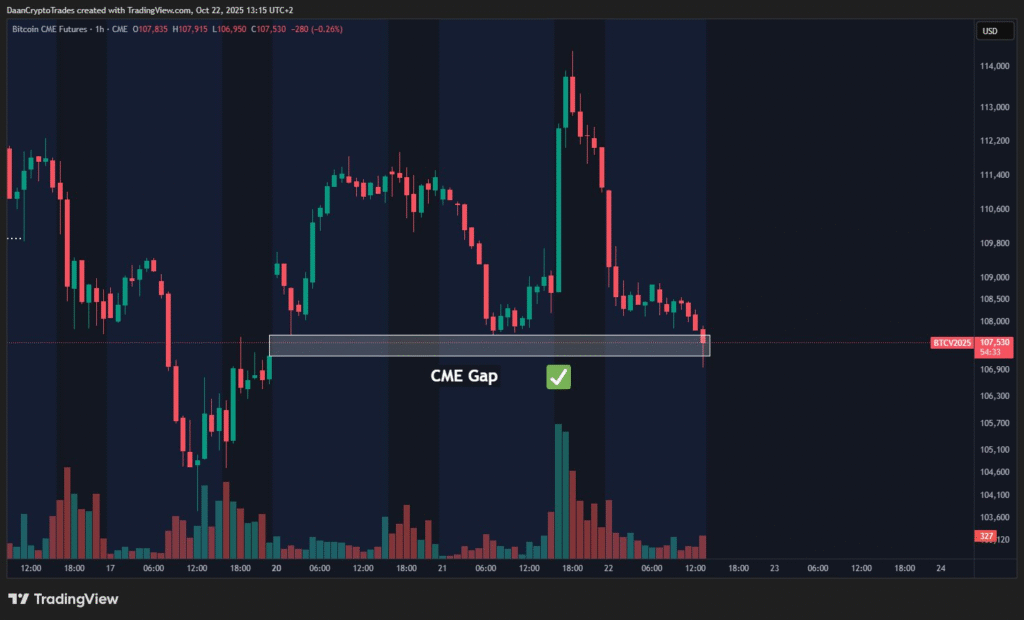

CME Gap Near $107K Gets Filled

Bitcoin has filled a recent CME gap located near the $107,000 mark. The CME gap refers to a price difference that forms when the Chicago Mercantile Exchange closes for the weekend and reopens at a different level. These gaps are often filled quickly and serve as areas of interest for traders.

Daan noted, “These might just be self-fulfilling prophecies, but the hit rate has been high.” The chart confirms a clear revisit to the gap zone, with the price reacting at that level.

Historically, CME gaps do not remain unfilled for long, and this latest event follows that pattern. Traders often track these gaps for potential short-term entry or exit points.

Market Structure Continues to Evolve

The combination of increased options activity and gap-filling behavior shows the evolving nature of Bitcoin’s trading landscape. Futures still play a large role in volume, but the data suggests they may no longer dominate directional influence.

With options gaining ground and technical events, such as CME gaps, continuing to guide short-term moves, the market is adapting to changing strategies. The current focus is on structure, defined risk, and precision, rather than broad speculation.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.