- BTC may retest $118,000 resistance if bulls maintain momentum.

- A breakout could drive prices to $124,000, despite bearish short-term signals.

- Whale activity and exchange deposits remain critical factors to watch.

Cryptocurrency analyst @CryptoFaibik has shared an insightful chart analysis on X, suggesting that Bitcoin (BTC) is currently trading within a descending channel.

This technical pattern indicates a potential bounce back, with the $118,000 resistance level in sight. Historically, BTC has shown a tendency to retest key resistance zones after consolidation, a trend supported by a 2023 study from the Journal of Risk and Financial Management on cryptocurrency price patterns. If bulls successfully break above $118,000, analysts predict a strong bullish momentum could push prices toward $124,000, aligning with recent web insights from bitcoinethereumnews.

However, the market remains at a crossroads. Current bearish sentiment, coupled with a rising 30-day moving average of exchange deposits, hints at a possible short-term correction. Large whale inflows, tracked by metrics like CryptoQuant’s Exchange Whale Ratio, have preceded past downturns, adding caution to the bullish outlook. A critical pivot point is approaching, and sustained buying pressure will be necessary to reclaim $118,000. TradingView’s neutral technical rating for BTC as of today reflects this uncertainty, emphasizing the need for confirmation of a breakout.

The broader market context also plays a role. Reduced exchange whale activity could signal accumulation, potentially supporting a bullish reversal. Conversely, macroeconomic factors like the U.S. Dollar Index (DXY) movements could influence BTC’s trajectory, as noted by X user@agentic_t, who called for deeper analysis. For now, the channel trading dynamic resembles a tennis match, with momentum swinging until a decisive break occurs, as aptly described by @DaMeta1.

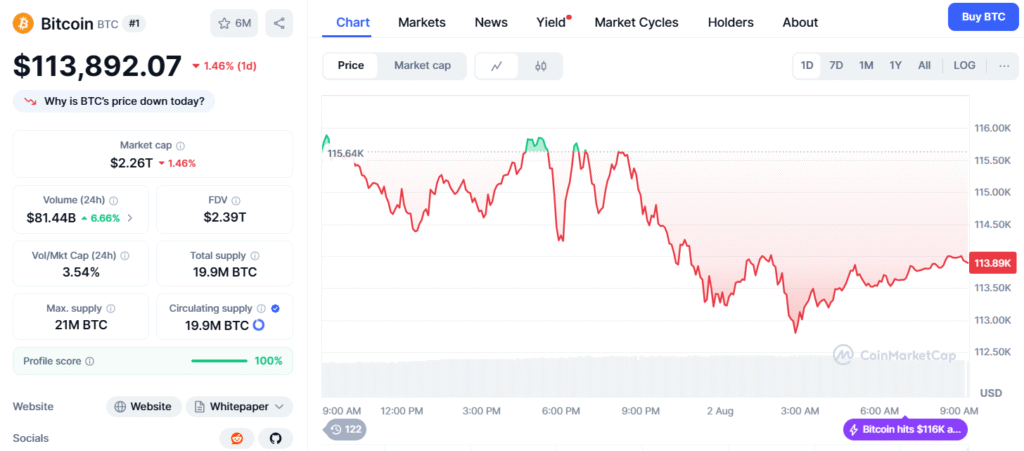

According to CoinMarketCap, as of today, $BTC is trading at $113K USD with a 24-hour trading volume of $81B USD and a market cap of $2.26T USD, reflecting a 1.46% decrease in the last 24 hours, which supports the bearish outlook.

Investors are advised to watch for volume spikes and key support at $110,000, which could determine the next move. Whether BTC breaks out or faces a fakeout, the coming days will be pivotal for the cryptocurrency market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.