- Over $1.5B in Bitcoin liquidations occurred in 24 hours amid a market downturn.

- CME’s opening triggered a 1% drop in Bitcoin, wiping out $16M in long positions.

- Traders are urged to monitor events like CME openings to avoid excessive leverage losses.

In recent market movements, Bitcoin has experienced a sharp decline, resulting in more than $1.5 billion worth of liquidations within 24 hours. This sudden price drop, which saw Bitcoin fall to $111,571, left many traders with significant losses.

Approximately 407,000 traders were affected by the liquidation, highlighting the market’s unpredictable nature. The decline caught many off guard, as typical technical analysis failed to predict the swift change.

Bitcoin had been trading at higher levels, hovering near its recent highs before the drop. This drastic move emphasizes the volatility that has become a common theme for the cryptocurrency market.

CME Opening Triggers Volatility and Massive Liquidations

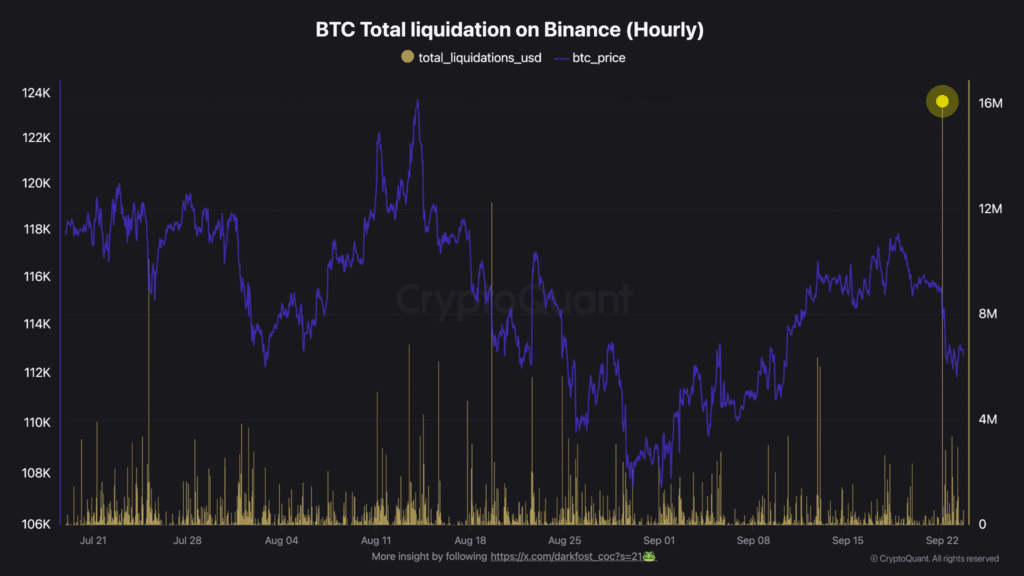

On September 22, the Chicago Mercantile Exchange (CME) opened, which led to significant volatility in the Bitcoin market. According to Darkfrost data, the CME, known for its high trading volumes and institutional exposure to Bitcoin, often acts as a catalyst for rapid price movements.

The opening saw Bitcoin drop by 1% within the first hour, causing a cascade of long position liquidations across various exchanges.

Binance, the second-largest crypto futures exchange, saw over $16 million in long positions liquidated in that single hour. This triggered the largest liquidation event on the platform in the past two months.

The surge in volatility serves as a reminder to traders of the risks associated with leverage, particularly when markets experience sharp, unexpected shifts.

Bitcoin’s Ongoing Struggles Amid Market Volatility

At the time of writing, Bitcoin is priced at $112,225.96, showing a slight 0.55% decrease over the past 24 hours.

The price movement has continued to show fluctuations, as seen in the chart, which displays periods of upward and downward shifts. The trading volume has also experienced significant changes, indicating the volatility surrounding Bitcoin.

The market’s instability continues to challenge traders, especially those relying on traditional technical analysis. While some might have expected Bitcoin to maintain its upward trajectory, the reality of unpredictable movements is taking a toll on many.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.