- Bitcoin struggles below $90,000 as positive US GDP growth fails to drive prices higher.

- Bitcoin may test lower levels if support around $88,000 doesn’t hold.

- Japanese market influence expected to play a role in Bitcoin’s next move.

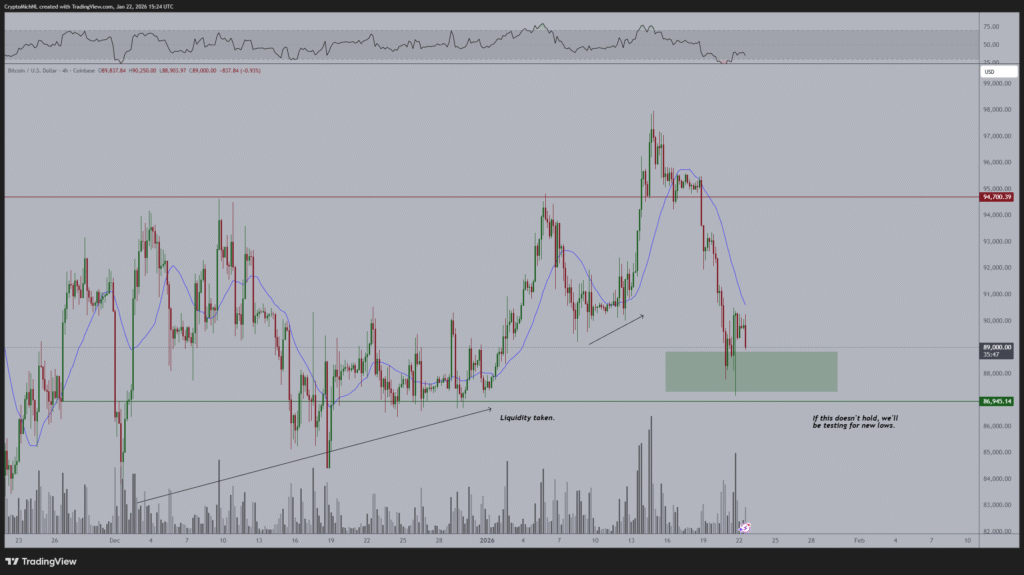

Bitcoin’s recent price action shows a consistent decline despite the positive US GDP growth numbers. Investors were hopeful that the strong economic growth in the US would provide a boost to cryptocurrencies, but Bitcoin continues to struggle in the face of broader market uncertainty.

The price fell below the $90,000 level, and despite attempts to bounce back, Bitcoin remains stuck in a downward trend.

Bitcoin’s price has been testing key support levels around the $88,000–$89,000 range. If these levels fail to hold, there are concerns that the price could move lower, testing new lows.

The market’s reaction has been tepid, with liquidity already absorbed at higher price points, and some analysts believe the market is awaiting signals from Japan to determine its next move.

Market Awaits Japan’s Influence as Bitcoin Struggles

Michaël van de Poppe, a prominent cryptocurrency analyst, highlighted that Bitcoin’s movements are currently at a standstill until Japan enters the market. “The markets aren’t going anywhere until Japan comes in,” he stated in a recent post.

While the US GDP growth suggests an acceleration in economic activity, Bitcoin has not responded positively. The market appears to be on hold, with traders waiting for Japanese traders to make their move, which could significantly influence Bitcoin’s price in the coming days.

The chart analysis from van de Poppe suggests that if Bitcoin cannot hold the key support levels around $89,000, it may face a continued downturn. This suggests that Bitcoin could face more downward pressure if support does not hold.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.