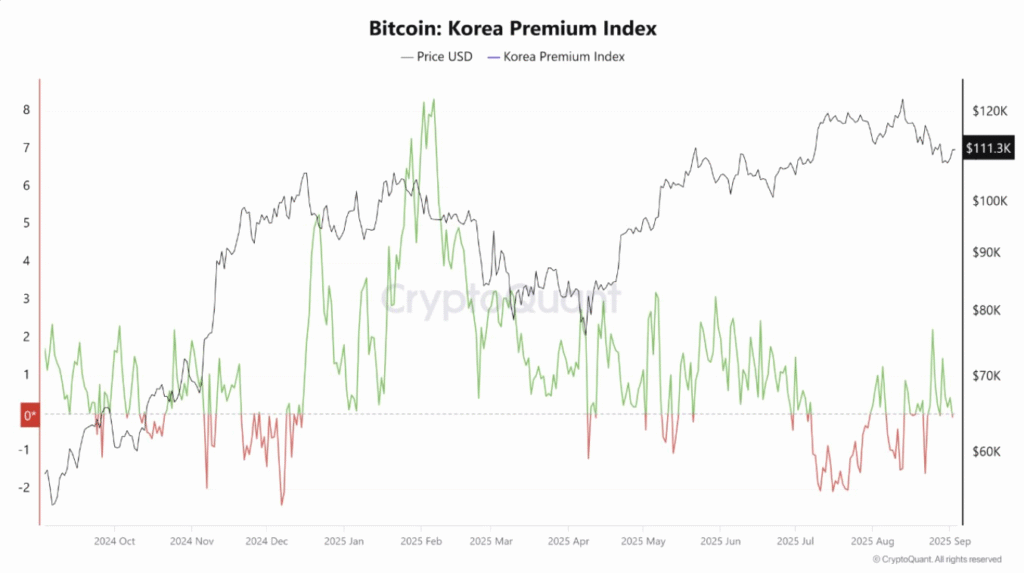

- Korea Premium Index shows overheating risk above 5 percent in Bitcoin trading.

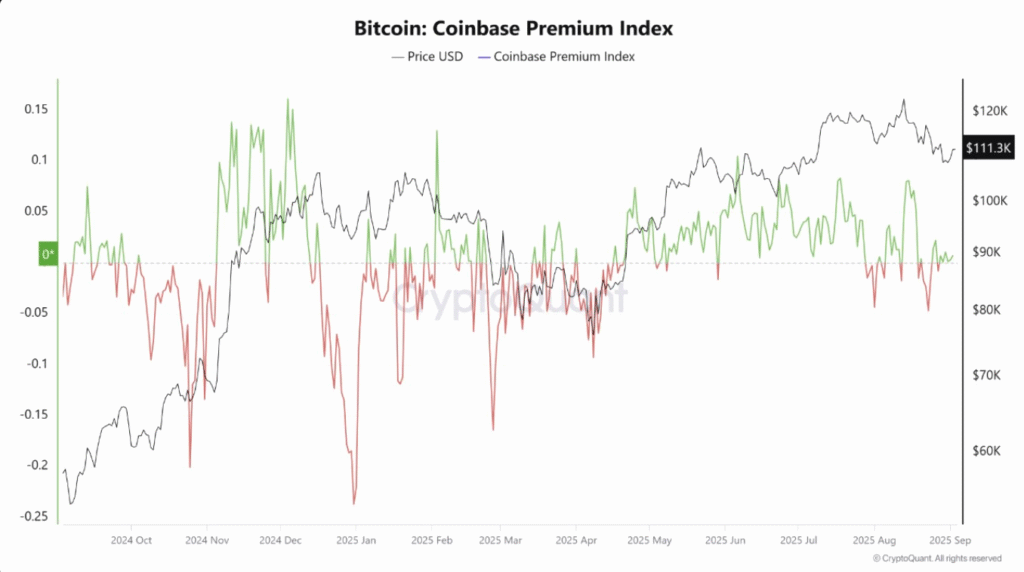

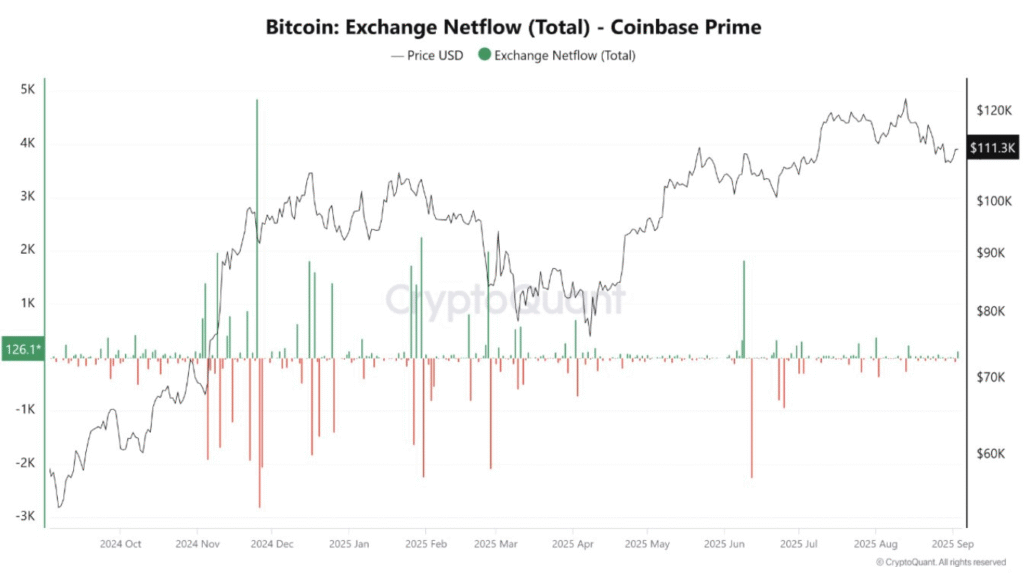

- Coinbase Prime outflows signal US institutional Bitcoin accumulation trends.

- Bitcoin consolidates between $104k and $116k with risk toward $93k–$95k.

Bitcoin’s latest moves reflect shifting liquidity between Asia and the United States. Analysts say Asian traders often spark short-term swings, while U.S. institutions determine whether momentum continues. Regional activity, premium indices, and ETF flows are now critical signals.

Asia Sparks Early Momentum

CryptoQuant reported that Asian traders still influence Bitcoin’s initial pushes. The Korea Premium Index, or “Kimchi Premium,” measures the price gap between Korean exchanges and global averages. When the index is between +1% and +3%, demand appears healthy. However, when it rises above +5%, it often signals overheating and short-term tops.

Recent patterns show that Korean traders remain active in early surges. Binance netflow data further highlights regional retail behavior. Inflows on Binance often reflect selling pressure, while outflows suggest dip-buying activity.

CryptoQuant noted that such flows frequently set the pace for Bitcoin’s daily movement. This shows that Asia continues to ignite momentum, but its impact remains short-lived without U.S. follow-through.

U.S. Institutions Shape the Trend

According to CryptoQuant, large investors in the United States play a decisive role. Outflows from Coinbase Prime often signal accumulation by institutions moving Bitcoin into custody. The Coinbase Premium Index, which compares Coinbase and Binance prices, highlights when U.S. demand is stronger. A positive premium has historically coincided with rallies holding longer.

Analysts also pointed to growing spot ETF influence in both the United States and Hong Kong. This new investment channel is shaping how sustained buying power enters the market.

In contrast, Binance netflows reflect the broader Asian retail crowd. Heavy inflows typically suggest upcoming selling, while steady outflows reveal dip-buying demand. Together, these indicators illustrate how Asia sparks early moves, but U.S. activity anchors the trend.

Consolidation and Market Levels

Glassnode reported that Bitcoin is consolidating within the $104,000 to $116,000 range. This zone follows substantial investor absorption. Futures and ETF flows currently show cooling demand. Analysts indicated that strength above $116,000 could revive the uptrend.

A breakdown, however, risks a decline toward $93,000–$95,000. Traders suggest Bitcoin’s next direction will depend on the interaction of regional liquidity. Asia provides the spark, while U.S. institutions decide if the flame sustains.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.