- SEC delays decisions on key cryptocurrency ETFs, creating market uncertainty.

- Renewed legislative efforts in the U.S. boost Bitcoin’s price recovery.

- Market sentiment remains cautiously optimistic amid ongoing regulatory challenges.

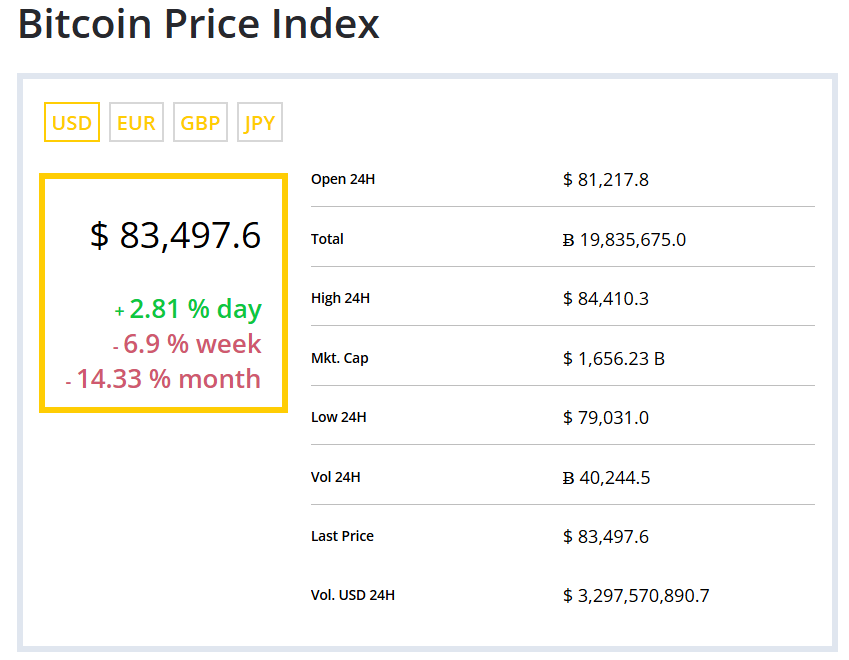

Bitcoin has bounced back up to $82,678.4 after briefly dipping below $78,000 Sunday. The rest of the significant cryptos follow suit, with Ether (ETH), BNB, XRP, and ADA up 3% or more. The broader market is up 4% as a whole. However, there is still uncertainty in the market as traders and investors wait for the US Securities and Exchange Commission (SEC) to make a decision on cryptocurrency exchange-traded funds (ETFs).

SEC Delays Crypto ETF Decisions

The SEC has delayed decisions on several key crypto spot ETFs. They have extended deadlines for Litecoin (LTC), Solana (SOL), XRP, and Dogecoin (DOGE). Key ETFs like the Canary Solana Trust ETF, VanEck Solana Trust ETF, and Grayscale Spot XRP ETF have had their deadlines pushed back to May 2025. The SEC had already acknowledged the 19b-4 filings but can extend the decision period by 60 days. According to Bloomberg’s James Seyffart, this is no surprise as the SEC’s process often takes time, especially when there is no confirmation from SEC Chairman Paul Atkins.

Seyffart remains upbeat, saying the chances are still high that these ETFs will get approved by October 2025. The delay affects not only crypto ETFs but also the iShares Bitcoin Trust ETF and Fidelity Wise Origin Bitcoin Fund. The market is in limbo until we get clarity on the regulatory environment.

Legislative Push for Bitcoin Reserve

A new legislative push is giving the market a boost. Senator Cynthia Lummis has re-introduced the BITCOIN Act, a bill that would have the US government buy 1 million BTC over 5 years as a reserve. The bill would strengthen Bitcoin’s position in the global financial system and create steady demand for the currency. Other cryptos like XRP and ADA could be added to the future reserve buys, giving the market hope.

Nick Ruck at LVRG Research says such legislation is helping the crypto market and will benefit Bitcoin and alts in the long run.

Market Outlook

Bitcoin is at $82,678.4, which is up 1.90% today. The RSI is 38.39, so Bitcoin is approaching oversold, which could be a buy signal. Despite the uncertainty of the SEC delays, the market is strong and driven by legislation and demand. As Bitcoin is at a lower $83,000 level, investors are watching legislative and regulatory updates that will shape the crypto’s path in the coming months.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.