- Bitcoin price surge leads to over $3.7B in realized profits on October 2, 2025.

- Citi’s updated forecast predicts Bitcoin will reach $133,000 by the end of 2025.

- Bitcoin’s profit-taking event signals strong volatility as investors cash in on gains.

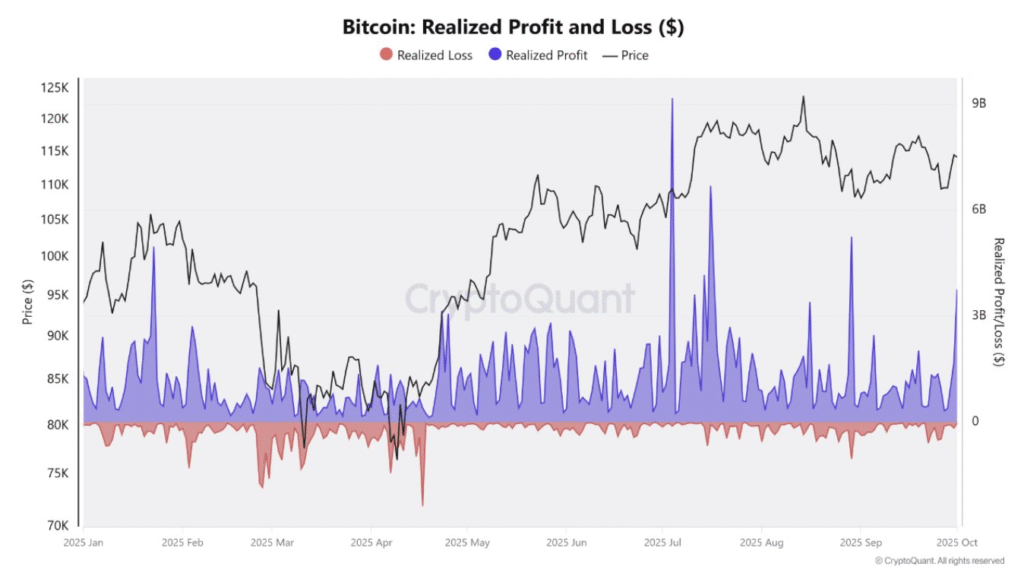

On October 2, 2025, Bitcoin reached a significant milestone as its price surged above $110,000. This price increase triggered a profit-taking event that saw realized profits surpass $3.7 billion.

CryptoQuant data shows that the surge in Bitcoin’s price, as indicated by the black line on the chart, was accompanied by notable spikes in both realized profits (blue) and realized losses (red). The large sell-offs highlight the ongoing volatility in the cryptocurrency market.

Bitcoin’s steady rise since late September culminated in this major profit-taking moment. As investors capitalized on the recent gains, the data showed a clear pattern of market fluctuations.

Citi Updates Price Forecasts for Bitcoin and Ethereum

In light of recent price movements, Citi has raised its cryptocurrency price projections. The Wall Street bank now expects Bitcoin to reach a price of $133,000 by the end of 2025, a slight revision from its previous forecast of $135,000.

This adjustment reflects the ongoing institutional demand for digital assets, particularly Bitcoin and Ethereum. The bank’s 12-month forecast for Bitcoin is even more optimistic, with a target of $181,000.

Citi attributed this anticipated growth primarily to the increased flow of capital through Bitcoin and Ethereum ETFs. These projections highlight the increasing institutional interest in the cryptocurrency market, which is anticipated to drive further price increases.

Profit-Taking Event Underlines Market Volatility

The fifth-largest profit-taking event in Bitcoin’s history serves as a reminder of the inherent volatility in the cryptocurrency market. While the price surge may indicate strong institutional interest, it also reflects the heightened risk for individual investors.

As Bitcoin hits new highs, the pattern of profit-taking events becomes increasingly common. Investors seeking to cash in on their gains contribute to these spikes in realized profits. Bitcoin’s market is expected to remain volatile in the coming months, with both positive and negative price movements likely to continue.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.