- Bitcoin sharks accumulated 65,000 BTC last week, raising total holdings to 3.65 million BTC.

- The surge in shark holdings could signal bullish market momentum for Bitcoin’s price.

- Bitcoin’s price is nearing key resistance levels, with potential to reach $120K-$125K.

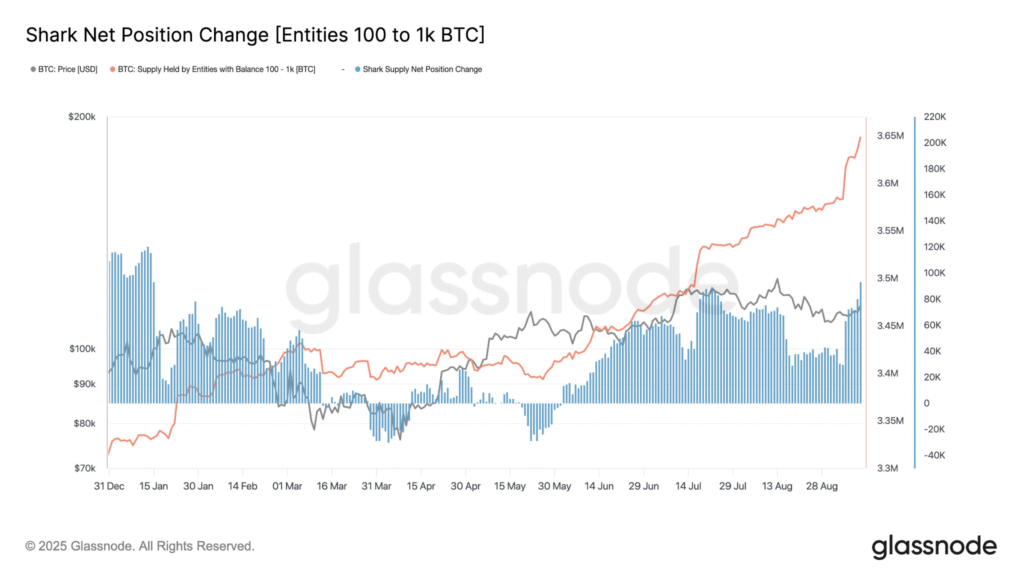

Recent data reveals that Bitcoin “sharks” entities holding between 100 and 1,000 BTC are significantly increasing their accumulation. This accelerated buying pattern has driven their total holdings to an all-time high of over 3.65 million BTC. As these mid-sized holders continue to stack Bitcoin, analysts suggest that the market could be primed for a major price surge.

Shark Accumulation at Record Pace

According to Glassnode, the net position of Bitcoin entities holding between 100 and 1,000 BTC has seen a sharp increase. Over the last seven days, this group added around 65,000 BTC to their wallets. On a broader scale, their 30-day net position has increased by 93,000 BTC.

This rapid accumulation reflects strong market confidence, as these holders continue to buy rather than sell. As of now, the total Bitcoin held by this cohort has reached 3.65 million BTC, signaling a potential shift in market dynamics.

Sharks have historically been a key indicator of Bitcoin’s long-term bullish potential. Their substantial buying activity often precedes major upward price movements. With their consistent additions to holdings, Bitcoin is increasingly becoming concentrated in fewer, more committed hands, which could have significant implications for future price levels.

What This Means for Bitcoin’s Price

Bitcoin is currently trading within a tight range between $90,000 and $100,000, but signs of an impending breakout are mounting. On-chain data shows that the recent shift in accumulation patterns, coupled with the price holding above crucial support levels like $112,000, suggests a potential for further bullish momentum. The latest price jump above $113,800 has already prompted increased buying across the market.

The key to Bitcoin’s next major move lies in breaking through resistance levels above $115,000. If this resistance is overcome, analysts predict that Bitcoin could quickly rally toward $120,000 or even $125,000. However, should the price dip below $103,000, the market may see further consolidation, with support levels around $98,000 providing potential buying opportunities.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.