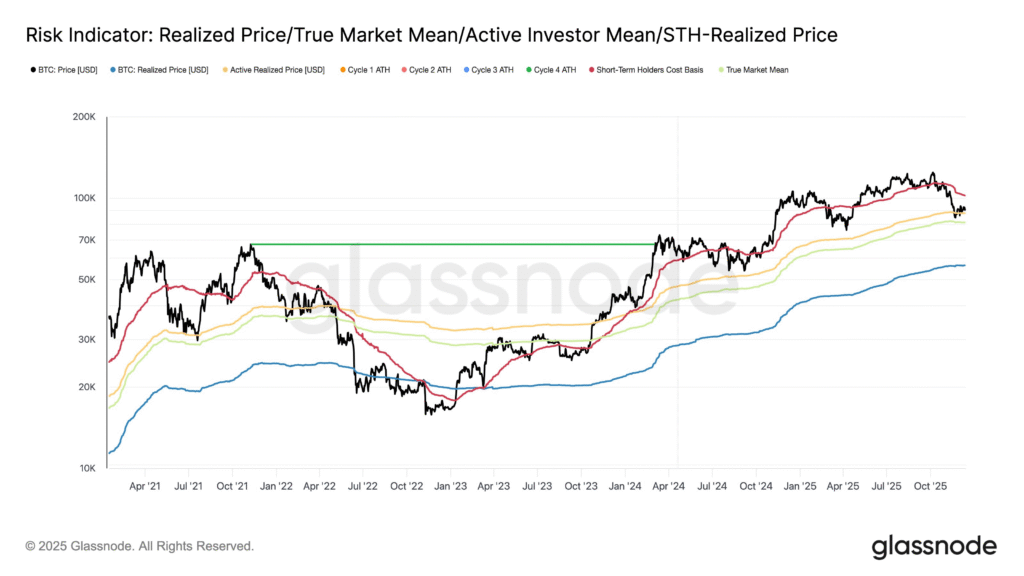

- Bitcoin trades below short-term holder cost basis of $102.2K, showing market pressure.

- The spot price holds above Active Investor Mean at $88.0K, signaling mid-range support.

- Realized price remains at $56.4K, showing long-term holders are still profitable.

Bitcoin continues to hover near $89,200, experiencing a minor 1.22% drop over the past 24 hours. The price decline follows an intraday high near $90,340, with trading activity showing a steady drop across major exchanges.

The spot price is currently positioned below the short-term holder cost basis of $102,200, but above other key support levels. On-chain data from Glassnode reveals that the spot price holds above the Active Investor Mean of $88,000 and the True Market Mean at $81,400, which has acted as a support in past market conditions.

Spot Price Between Key Investor Cost Levels

According to Glassnode, Bitcoin’s spot price is trading below the short-term holder (STH) cost basis of $102,200. This level represents the average acquisition price of coins held by investors who have recently bought Bitcoin.

At the same time, the spot price remains above the Active Investor Mean, which stands at $88,000. This level represents the cost basis for coins that have recently changed hands. The True Market Mean, which adjusts for broader investor positions, sits at $81,400.

Glassnode noted, “With the spot price still trading around $90,200, the key on-chain price models have not shifted significantly,” showing that while short-term holders face pressure, the market has not experienced sharp declines.

Realized Price Signals Long-Term Support

Bitcoin’s realized price is another key metric that analysts are monitoring. At $56,400, the realized price remains well below the current market price, reflecting the average acquisition price of all circulating Bitcoin.

The distance between the spot price and realized price suggests that long-term holders are not feeling significant stress. They purchased their Bitcoin at much lower levels than the current market price, which provides a cushion against short-term market movements.

Additionally, on-chain data shows no sharp changes in cost basis trends, indicating measured market behavior during the recent pullback.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.