- Only 9% of Bitcoin supply is at a loss, indicating market resilience.

- Short-term traders caused the recent dip while long-term holders remain confident.

- SEC and CFTC issue joint statement signaling a potential boost for spot crypto trading.

Bitcoin has shown remarkable resilience during the recent dip in market prices. Data from Glassnode reveals that only about 9% of the total Bitcoin supply is currently at a loss, and unrealized losses are limited to roughly 10%.

This situation contrasts with earlier points in the market cycle, where over 25% of Bitcoin supply was underwater and losses were more significant. Even during past bear markets, losses were much deeper, with more than 50% of Bitcoin supply experiencing a loss as steep as 78%.

The latest figures suggest that the current dip is relatively mild and may indicate stronger investor confidence. The market’s current stability seems to reflect better positioning by investors compared to previous market cycles.

Short-Term Traders Drive the Dip

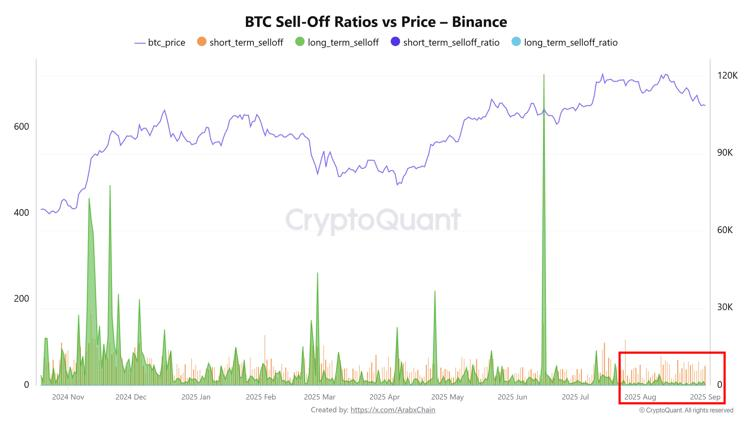

CryptoQuant’s recent data shows that short-term traders largely drove Bitcoin’s recent dip to around $108,000. These traders appear to have taken profits at resistance levels, keeping Bitcoin’s price below $120,000. According to analysts, this is a sign of healthy profit-taking rather than weakness in the market structure.

Long-term holders, on the other hand, have continued to hold their positions. These holders, who typically see Bitcoin as a long-term investment, have maintained their confidence in the broader market trend, which indicates that despite the pullback, sentiment remains bullish.

SEC and CFTC Clarify Stance on Spot Crypto Products

The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) recently issued a joint statement clarifying the rules around the trading of spot crypto assets.

The statement confirmed that exchanges registered with the SEC and CFTC are not prohibited from facilitating the trade of spot crypto assets. This announcement has been well-received by analysts, with many considering it a positive step for the crypto industry.

At the time of writing, Bitcoin is trading at $111,223.71, showing a 1.98% increase in the last 24 hours. This price action reflects the continued stability and growth of the market despite recent fluctuations.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.