- Bitcoin’s surge past $90K aligns with rising retail investor participation.

- Large holders reduced positions, indicating possible short-term market resistance.

- Bitcoiney resistance at $92,800, with support at $89,000.

Bitcoin has surged past the $90,000 mark, reinforcing its volatile trajectory amid increasing market participation. Recent data reveals a sharp rise in new wallet addresses, suggesting growing interest from retail and institutional investors. However, profit-taking among large holders introduces caution, as their activity often influences price trends. As reported by CoinCryptoNews, Bitcoin is facing key resistance and support levels; traders are closely watching for signs of its next significant move.

Retail Investors Drive Wallet Expansion

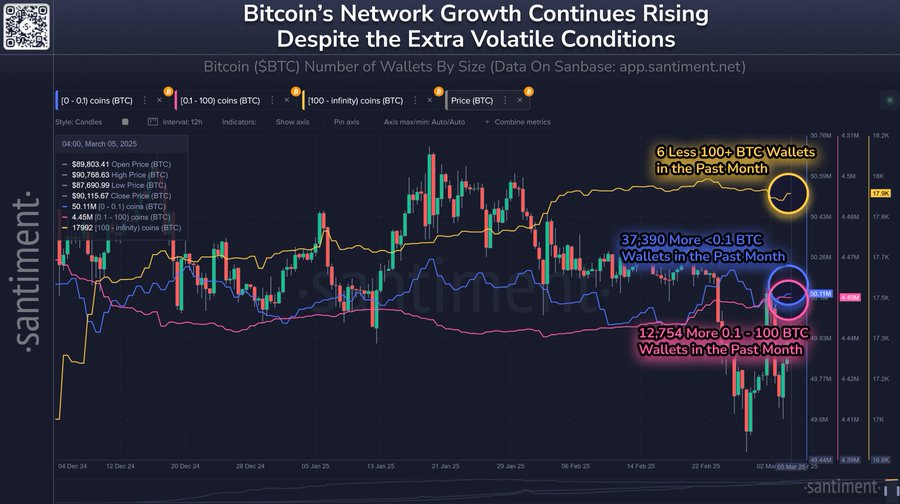

Data from Santiment on X indicates a surge in smaller Bitcoin wallets, signaling increased retail adoption. Over the past month, addresses holding less than 0.1 BTC grew by 37,390, reflecting heightened interest from individual investors. Mid-tier wallets, holding between 0.1 and 100 BTC, also increased by 12,754, showing broader accumulation.

Analysts suggest this trend enhances long-term market stability, as retail investors hold assets for extended periods. The growing confidence in Bitcoin comes despite its recent price swings, highlighting sustained optimism in the market.

Whale Activity Hints at Profit-Taking

While smaller wallets grew, the number of large holders showed a slight decline. The number of wallets holding at least 100 BTC decreased by six over the past month, indicating some profit-taking among high-net-worth investors. Historically, reduced whale activity has coincided with temporary resistance in Bitcoin’s price movements. Analysts closely monitor whether these large holders resume accumulation, as their influence often drives market trends. Bitcoin may face short-term resistance if whale activity remains low before resuming its upward momentum.

Market Outlook Hinges on Institutional Moves

The balance between retail accumulation and whale activity is key to Bitcoin’s short-term trajectory. A resurgence in considerable holder accumulation could indicate renewed institutional confidence, potentially fueling further price gains. Conversely, continued reductions in whale holdings might signal extended profit-taking, slowing Bitcoin’s upward momentum.

Technical analysis suggests Bitcoin faces resistance near $92,800, a level it has struggled to break. If this is clear, the next target could be $95,000, while support levels hold at $89,000 and $85,000. The Relative Strength Index (RSI) at 48.18 reflects neutral momentum, leaving room for price movement in either direction. With high volatility, investors are closely watching Bitcoin’s next decisive move.