- Bitcoin leverage increased by $2.4B during December market fear

- Network activity declined by about 40% during the same period

- Whales withdrew nearly 20,000 Bitcoin from exchanges

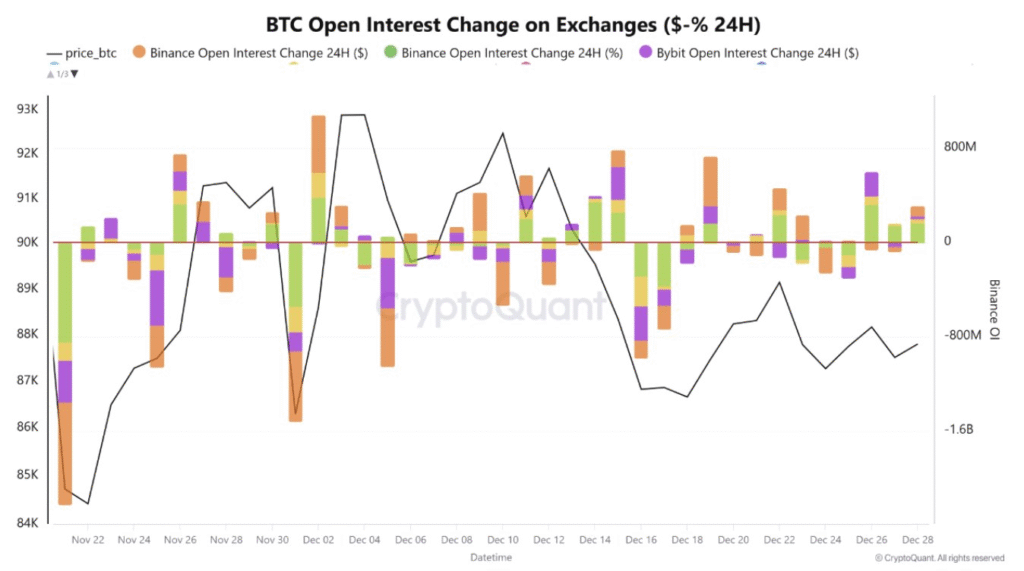

Bitcoin traders increased leverage sharply in December during heightened market fear.

On-chain data shows leverage expanded even as activity slowed across the Bitcoin network.

CryptoQuant reported that traders added about $2.4 billion in leverage during the month.

This occurred while overall network activity declined by nearly forty percent.

At the same time, large Bitcoin holders reduced exposure and moved funds off exchanges.

The data showed a clear difference between retail traders and professional participants.

Retail Leverage Increased Despite Lower Network Activity

CryptoQuant data shows open interest increased across major Bitcoin trading platforms.

The rise reflected greater use of borrowed capital by traders.

However, on-chain metrics showed lower transaction volumes during the same period.

Exchange inflows and address activity also declined across the network.

CryptoQuant analyst @Crazzyblockk described the market shift.

“Activity collapsed by forty per cent, and whales withdrew twenty thousand Bitcoin,” the analyst stated.

The data suggests retail traders maintained market exposure despite reduced activity.

Leverage continued to rise while price movement remained unstable.

Whale Withdrawals Reflected Reduced Professional Participation

Large Bitcoin holders withdrew approximately 20,000 BTC from exchanges in December.

These withdrawals reduced the amount of Bitcoin available on trading platforms.

The analyst stated that professional money exited during the same period.

Retail traders, however, increased leverage across derivatives markets.

Exchange balance data confirmed sustained outflows from large wallets.

These movements aligned with reduced institutional trading activity.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.