- Bitcoin’s price action shows repeated consolidation-sweep-retake-expansion cycles, trending higher but compressing lately due to ETH’s dominance.

- Compressed volatility often precedes big moves; watch for failures in range retakes or new highs as bearish signals.

- ETH outperforms with superior long-term returns, potentially signaling a shift in crypto market leadership.

In the ever-volatile world of cryptocurrency, Bitcoin ($BTC) continues to captivate traders with its methodical yet suspenseful price action.

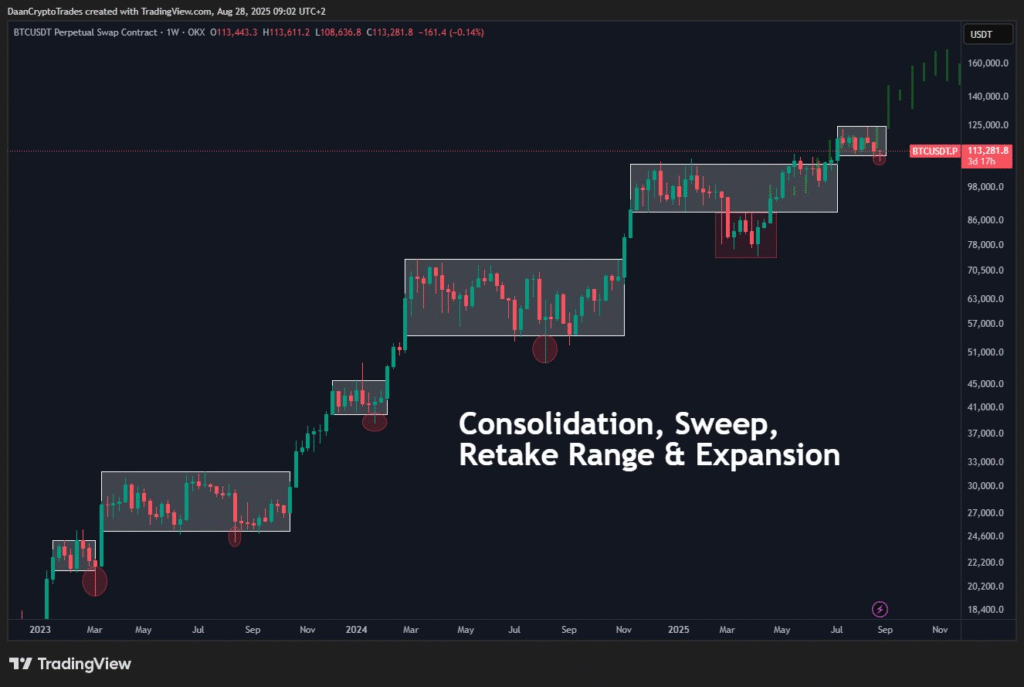

Renowned crypto analyst DaanCrypto, with over a decade of market experience, recently shared a compelling chart on X (formerly Twitter) that has the community buzzing. Posted on the analysis underscores BTC’s ongoing uptrend, characterized by repeated cycles of consolidation, liquidity sweeps, range retakes, and expansions.

However, Daan warns that the current compression phase—exacerbated by Ethereum’s ($ETH) spotlight-stealing performance—could soon culminate in a significant directional move.The chart, sourced from TradingView, illustrates BTC’s weekly perpetual swap contract from 2023 to mid-2025. Starting from lows around $20,000 in early 2023, BTC has climbed to current levels near $113,281, as per OKX data embedded in the visual. Annotated with boxes highlighting key phases, it shows how BTC consolidates within ranges, dips below to sweep liquidity (marked by red circles), reclaims the range, and then expands higher. This pattern has repeated multiple times, building a staircase-like ascent. Yet, Daan notes the action has slowed in recent weeks, with volatility compressing as ETH surges ahead.

Historical data supports this observation. According to Bitbo.io, Bitcoin’s daily standard deviation has averaged 5-7% during similar compression periods over the past decade, often preceding explosive moves. Ethereum’s recent outperformance adds intrigue; as of August 28, 2025, ETH traded at $4,541.29 on CoinMarketCap, down just 1.68% in 24 hours, while boasting a 10-year annualized return of 124.17% versus BTC’s 86.20%, per PortfoliosLab. This shift challenges the traditional narrative of BTC as the undisputed market leader, potentially diverting capital and attention.

Daan advises vigilance for red flags: failure to retake ranges post-deviation or to achieve new highs could signal a bearish reversal. A TradingView analysis from August 26, 2025, echoes this, projecting downside to $60,000 by 2026 if sellers hold below $116,800 support. Conversely, a volatility spike could propel BTC to new all-time highs, reigniting the bull run.

As Web3 evolves, such insights remind us of crypto’s inherent risks and rewards. Traders should monitor on-chain metrics and macroeconomic cues, like potential Fed rate adjustments, to navigate this phase. With BTC’s dominance at stake, the next move could redefine the market landscape.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.