- Bitcoin’s decline in dominance suggests that altcoins may experience growth as market conditions shift.

- Long-term holders’ behavior signals Bitcoin’s strength despite short-term drops.

- Bitcoin’s MVRV ratio indicates a healthy market environment for future growth.

Recent developments in the cryptocurrency market indicate a weakening of Bitcoin’s dominance, potentially creating an opportunity for altcoins to thrive. According to a tweet from el_crypto_prof, Bitcoin has broken out of a two-year-long ascending broadening wedge pattern. As the market undergoes a bearish backtest, this could signal the end of a downward phase and set the stage for altcoins to experience a rally.

Bitcoin’s dominance is experiencing a decline, which typically leads to an increase in altcoins. The current market setup mirrors past instances when Bitcoin’s dominance dropped, and altcoins surged in response. As Bitcoin’s dominance decreases, the analyst suggests altcoins could take the lead.

Bitcoin’s Bull Market Still Intact, Experts Weigh In

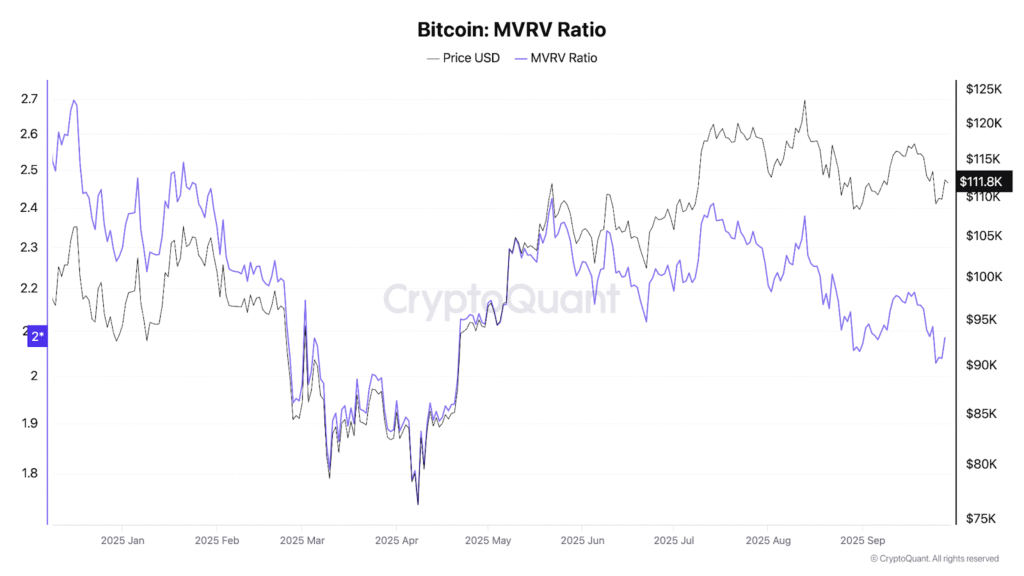

Despite concerns around Bitcoin’s recent price pullbacks, experts suggest that the cryptocurrency’s bull market is far from over. XWIN Research Japan, in a CryptoQuant note, pointed out that on-chain data, such as Bitcoin’s Market Value to Realized Value (MVRV) ratio, remains strong.

The MVRV ratio, which measures Bitcoin’s market value against the average cost basis of holders, indicates that Bitcoin is not in panic or euphoria territory.

“Bitcoin’s recent pullbacks appear more like a period of digestion, not the end of a rally,” XWIN explained. The research firm further noted that long-term holder behavior has remained stable, with profit-taking by long-term investors on the decline. This suggests that the market is experiencing consolidation, not the end of Bitcoin’s bull market.

Market Volatility and Liquidations

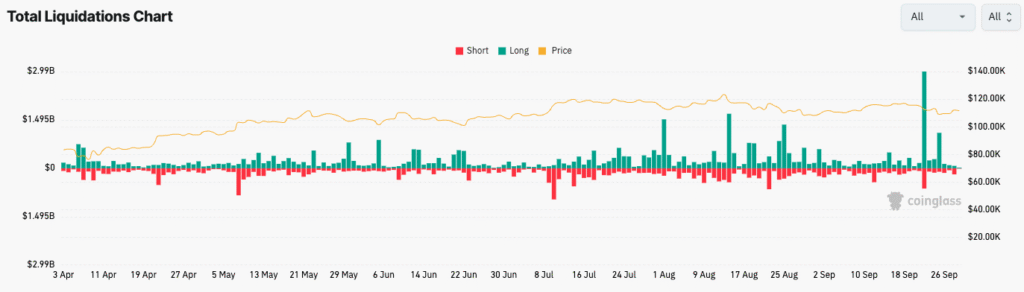

Despite the positive outlook for Bitcoin, the market recently experienced significant volatility. On September 22, over $3 billion in long positions across the crypto market were liquidated as Bitcoin’s price fell below $112,000. This was followed by an additional $1 billion liquidation on September 25 when Bitcoin’s price dipped to $109,000.

These liquidations have been hard on crypto bulls, but experts argue that the market is still showing resilience. The drop in Bitcoin’s price has resulted in decreased available supply, potentially setting the stage for a market rebound. The price adjustments may help prepare the market for the next upward movement.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.