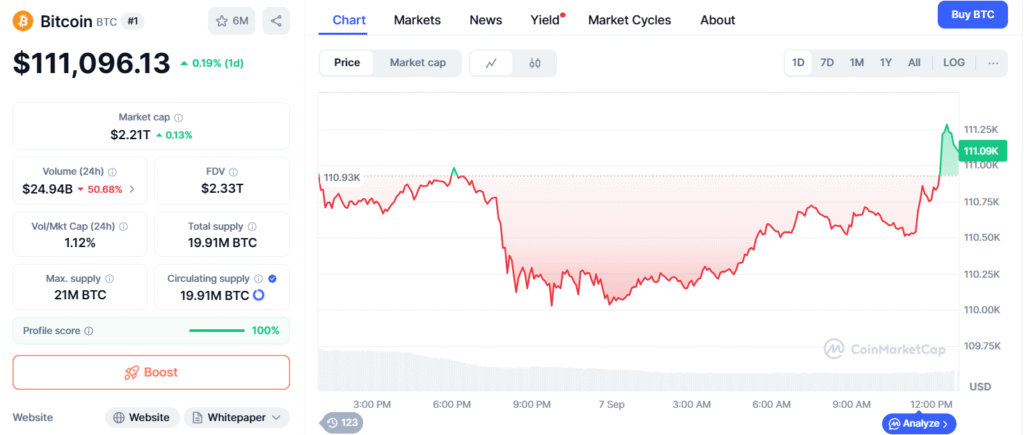

- Bitcoin achieves a remarkable 122-day streak above $100,000, transforming the six-figure mark into a potential long-term support level.

- With a current price of $110,530 and market cap of $2.2 trillion, BTC’s dominance stands at 57.8%, underscoring its market leadership.

- Despite September’s historical bearishness, experts see this resilience as a sign of maturing crypto adoption, though risks of a dip to $100K loom.

In the ever-evolving world of Web3 and decentralized finance, Bitcoin ($BTC) continues to defy gravity.

As highlighted in a recent post by prominent crypto analyst CryptoPatel, Bitcoin has now maintained its price above the $100,000 threshold for an astonishing 122 consecutive days—over four months of unwavering six-figure territory.

This milestone, captured in a TradingView chart showing BTC’s daily candles hovering comfortably above the blue $100K line from May through September 2025, isn’t just a number; it’s a testament to Bitcoin’s growing stability in a notoriously volatile market. Back in 2023, skeptics abounded. A study from the National Bureau of Economic Research indicated that only 30% of analysts believed Bitcoin could sustain levels above $100K due to regulatory hurdles and macroeconomic pressures. Fast forward to today, and the narrative has flipped.

As of September 7, 2025, Bitcoin trades at $110,530.14 with a staggering market capitalization of $2.2 trillion. Its dominance over the broader crypto market sits at 57.80%, reflecting how BTC has become the de facto “digital gold” amid altcoin fluctuations and economic uncertainty. This endurance comes at a pivotal time. The crypto market has seen explosive growth post-2024 halving, with institutional players like BlackRock and Fidelity pouring billions into spot ETFs.

Yet, challenges persist. September has historically been a “red month” for Bitcoin, with recent analyses warning of potential slides to $100K due to breached support levels and bearish technical indicators. For instance, CoinDesk reports increasing bearish momentum, suggesting a risk of correction after a 6% monthly drop. CryptoTicker echoes this, citing $15B in expiry pressure that could push BTC lower.

However, not all is doom and gloom. Traders like those on CoinTelegraph argue that losing $100K support could end the bull market, but Bitcoin’s current resilience—snapping three years of negative summer returns—hints at a breakout. Reddit communities buzz with optimism, viewing this as a sign of market maturity.

Even CryptoSlate notes that despite 100+ days above $100K, retail interest remains subdued, potentially setting the stage for a “lonely” bull run explosion. For Web3 enthusiasts and investors, the question shifts: What’s next? If Bitcoin holds this baseline, we could see altseasons ignite or further institutional adoption. But with miner sell-offs and seasonal dips in play, savvy traders are watching key supports closely. In the decentralized future, Bitcoin’s streak proves one thing—crypto isn’t just surviving; it’s thriving.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.