- Bitcoin’s 30-day MA crossing above 90-day MA signals shift in sentiment.

- Institutional demand for Bitcoin remains strong despite recent price drops.

- Bitcoin may be in a distribution phase, awaiting clearer accumulation signs.

Bitcoin Fear and Greed Golden Cross Signals Potential Rally

Bitcoin’s market sentiment has shifted recently, according to CryptoQuant’s analysis. The Fear and Greed Index is showing a “golden cross” pattern, where the 30-day moving average (MA) has crossed above the 90-day MA for the first time since May 2025.

This crossover signals that short-term sentiment is improving faster than the broader market trend. While this isn’t a sign of extreme optimism, it could suggest a positive price movement in the coming weeks.

Historically, golden crosses occur after prolonged fear phases and near price compression zones. This indicates that Bitcoin could see upward momentum in the near future.

Where Is Bitcoin’s Price Bottom?

Some analysts believe Bitcoin’s price has entered a bearish phase. However, many still expect Bitcoin to recover and move higher eventually. The key debate is how deep the current pullback might go.

Bitcoin’s 2025 rally started near the $74,000 level, with some analysts suggesting that a return to this range is possible. While opinions remain split, many believe that the pullback will not last long.

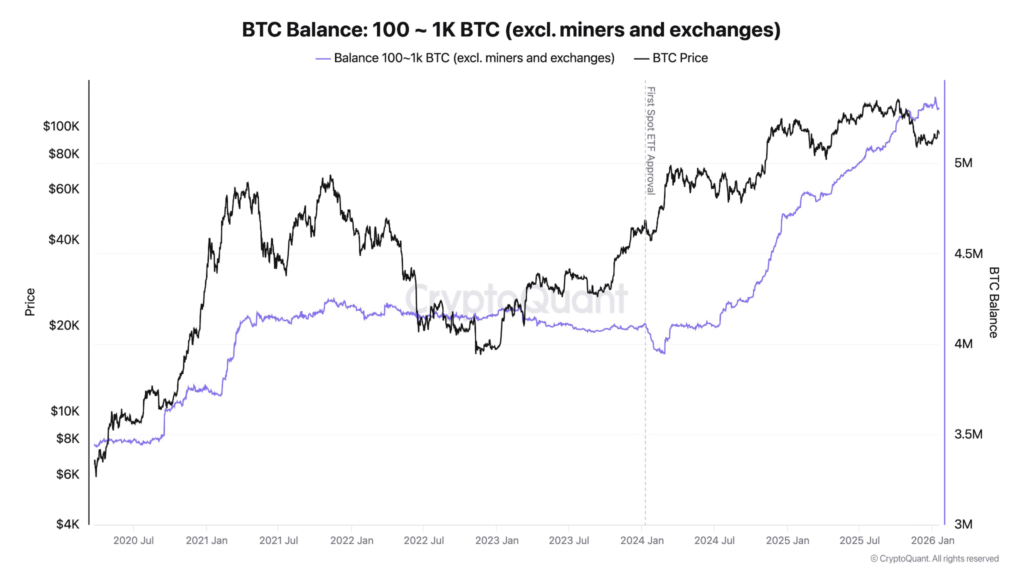

Ki Young Ju, the founder of CryptoQuant, notes that institutional demand for Bitcoin remains strong despite recent price declines. According to Ju, US custody wallets typically hold 100 to 1,000 BTC each, and excluding exchanges and miners, this reflects institutional demand.

Over the past year, 577,000 BTC ($53 billion) have been added to these wallets, indicating sustained institutional interest. However, this suggests Bitcoin may be in a distribution phase. Large players appear to be reallocating liquidity, and the market is likely waiting for clearer signs of accumulation before moving to the next major price phase.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.