According to new on-chain data from Glassnode, Bitcoin’s recent rally is being driven by a surge in new investor demand.

In a tweet, Glassnode highlighted that its Supply Mapping chart shows the Relative Strength Index (RSI) for first-time Bitcoin buyers has held steady at 100 for an entire week — a rare and significant signal of strong entry-level demand.

“First-time buyer RSI at 100 for a week straight, while momentum buyer RSI is only at 11,” Glassnode noted, pointing to a divergence that suggests enthusiasm from new entrants but weaker follow-through from seasoned investors.

The low RSI of 11 among momentum buyers indicates that while fresh capital is entering the market, broader continuation from existing traders remains limited — a dynamic that could temper short-term upside.

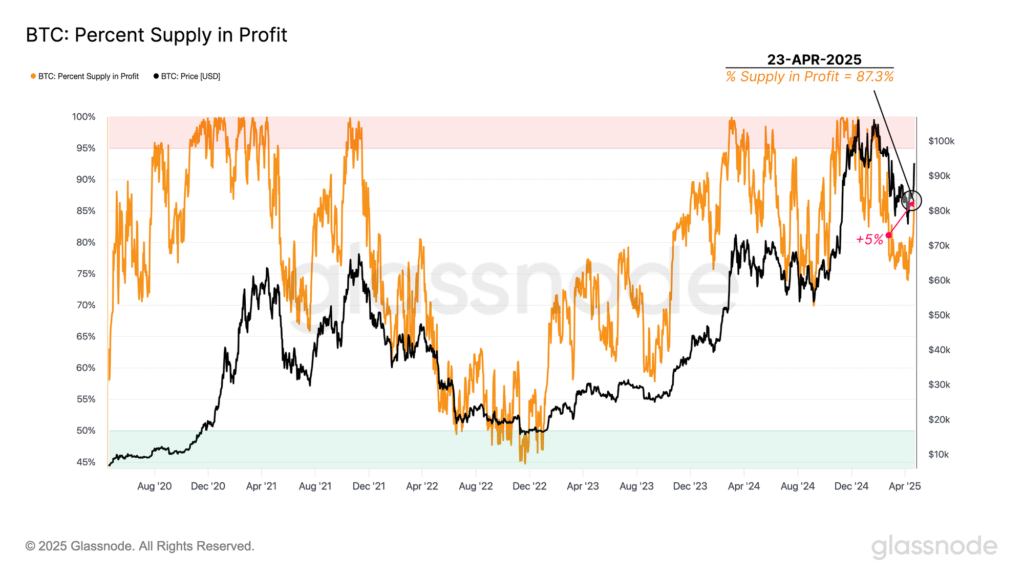

Additionally, Glassnode observed a rise in profit-taking, a trend historically known to precede market consolidation, particularly when not accompanied by sustained momentum buying. If this pattern holds, Bitcoin could face some near-term selling pressure.

The Supply Mapping heatmap, a core visual in Glassnode’s analysis, shows buyer cohort behavior over time, with green and red hues representing activity intensity. Since April 2025, first-time buyer strength has remained elevated — a bullish sign of renewed retail and institutional confidence.

This resilience is notable amid macro uncertainties such as recent tariff announcements by former U.S. President Donald Trump, which have stirred broader economic unease. Despite these headwinds, on-chain signals suggest Bitcoin’s foundation remains strong.

Conclusion:

Glassnode’s latest on-chain data reveals a compelling shift in Bitcoin market dynamics, with first-time buyers leading the charge amid subdued momentum from seasoned traders. While the sustained RSI of 100 signals strong new demand, the lack of follow-through and increasing profit-taking could introduce short-term volatility.

Still, the continued accumulation, even in the face of macroeconomic headwinds, reflects growing investor confidence and suggests that Bitcoin’s long-term bullish outlook remains intact. As always, market participants are advised to monitor both on-chain trends and external events closely.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.