- Institutional Demand is Key to Bitcoin’s Growth: Bitcoin’s price fluctuations are strongly influenced by institutional buying activity, with current low demand hindering significant growth.

- Volatility Amid Low Institutional Interest: Despite a steady price above $89,000, Bitcoin’s volatility reflects a market struggling to gain momentum due to reduced institutional involvement.

- Long-Term Outlook Hinges on Institutional Confidence: For Bitcoin to see any major rally, institutional demand must increase, as historical rallies have been driven by large investors.

Bitcoin’s price continues to show significant volatility, reflecting fluctuations that are largely driven by shifts in institutional demand. Recent data reveals a noticeable drop in Bitcoin’s institutional demand, impacting its price movements. Despite this, Bitcoin’s value remains above the $89,000 mark, though the market is not experiencing the kind of upward momentum that some had anticipated.

Institutional Demand Hits Low Levels

Bitcoin’s institutional demand is at its lowest point since March 2025. This decline in demand from large-scale investors has made a noticeable impact on the market. Institutional investors typically influence Bitcoin’s price significantly, as their buying and selling activities can lead to sharp price movements.

Bitcoin’s price has faced volatility, with fluctuations in the $89,000 range, indicating the influence of these institutional trends. When large investors show reduced interest, it often signals a period of low market confidence. As a result, the price of Bitcoin has not seen substantial growth recently.

The correlation between Bitcoin’s price movements and institutional buying trends is becoming more apparent. With demand dropping, Bitcoin’s market activity is less likely to lead to a major rally without a resurgence in institutional interest. This shift could signal that Bitcoin’s price may remain stagnant for the time being unless institutional demand picks up.

Impact on Bitcoin’s Price Performance

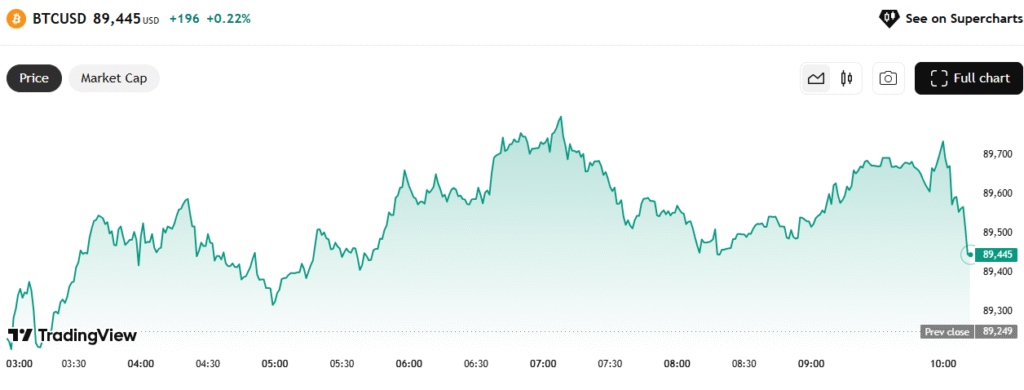

Bitcoin’s price fluctuations between 03:00 and 10:00 demonstrate how price changes can correlate with external factors, such as institutional demand. The market saw initial declines at 03:00, followed by recovery, but not enough to indicate long-term growth. Between 04:00 and 06:00, Bitcoin’s price showed signs of an increase, peaking above $89,700, yet the momentum faded quickly.

Bitcoin’s price, which briefly dipped below $89,000, has shown signs of stabilization around the $89,400 mark by 10:00. However, the volatility observed earlier in the day highlights the role that institutional demand plays in pushing Bitcoin’s price up or down. Without increased institutional buying, Bitcoin’s price is unlikely to see a significant rally.

Bitcoin’s price is also impacted by sudden market movements, often responding to news or market events. With institutional demand at low levels, Bitcoin’s market behavior remains more reactive rather than driven by sustained buying pressure. This shift is a clear signal that institutional involvement will be key to any potential upward movement in Bitcoin’s value.

Bitcoin’s Market Outlook: A Rally Dependent on Institutional Support

For Bitcoin to achieve any substantial growth, institutional demand must increase. Historically, Bitcoin’s major rallies have coincided with significant institutional involvement. Currently, with demand at a low point, Bitcoin’s price struggles to maintain upward momentum.

The downward trend in institutional buying could signal a prolonged period of stagnation for Bitcoin. As large investors hesitate, Bitcoin’s price struggles to break free from a narrow trading range. Without a rebound in institutional interest, Bitcoin may continue to face downward pressure, making it difficult for the market to build a solid foundation for future growth.

Bitcoin’s price dynamics remain influenced by a complex relationship with institutional demand. While short-term fluctuations continue, the long-term outlook for Bitcoin heavily relies on the return of institutional confidence and buying activity. Until that happens, Bitcoin’s price may remain locked in a state of volatility.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.