- Bittensor’s subnet demand rose 11% as usage and developer activity expanded.

- Futures open interest jumped 19%, reflecting stronger market participation.

- TAO broke above $434, confirming a bullish reversal on key timeframes.

Bittensor (TAO) has experienced renewed upward momentum, rebounding strongly after a brief pullback. Rising interest in decentralized AI networks and growing demand for its subnets have supported the token’s recovery. Despite short-term volatility, the market outlook remains focused on whether TAO can maintain its strength toward the $500 mark.

Bittensor Gains Momentum Amid Growing AI Network Demand

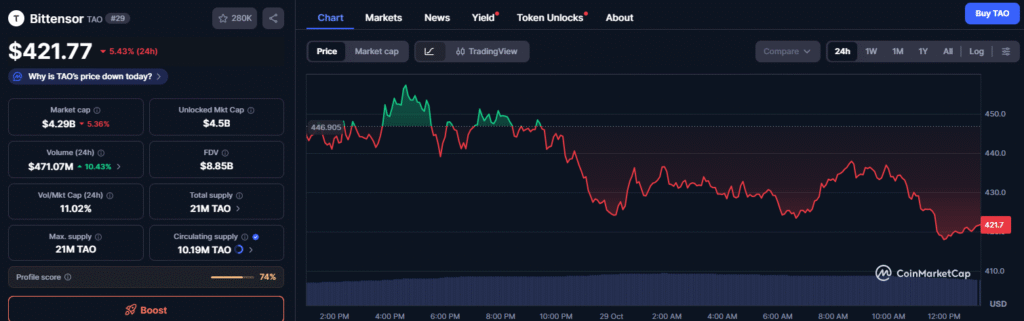

Bittensor (TAO) traded at $421.77, down 5.43% in the past 24 hours after earlier surging past $450. The price movement followed a period of renewed buying pressure driven by stronger interest in decentralized AI applications and subnet activity.

Analysts observed that increased market engagement has reinforced confidence in the project’s long-term potential.

The rally began after TAO rebounded from the $280–$300 support zone, breaking above the $434 resistance level, which has now turned into short-term support. The breakout pattern suggests improving technical strength, with resistance now expected around $466–$475, and a possible extension toward $500 if momentum continues.

Technical Indicators Show Uptrend Potential

Chart data shows TAO trading above both the 50-day and 200-day moving averages, indicating a confirmed uptrend. Analysts note that the convergence of these averages suggests a possible “golden cross,” a common indicator of longer-term strength. Trading volume has also increased by over 10%, reflecting growing market activity.

Market data shows a $4.29 billion market cap and $471 million in 24-hour trading volume. Futures open interest rose by 19%, signaling active participation from traders and institutions. The relative strength index (RSI) at 63 shows healthy buying pressure without signs of overextension.

Investor Confidence Strengthened by Network Expansion

The Bittensor network has recorded an 11% jump in subnet market capitalization within 24 hours. This rise reflects higher usage and expanding developer contributions, which have fueled optimism among investors. Analysts suggest that these fundamentals may support further price growth if demand continues to increase.

Market observers are now watching whether TAO can maintain momentum above $440, a key pivot level. A sustained move above this area could confirm a shift in market sentiment toward continued bullish conditions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.