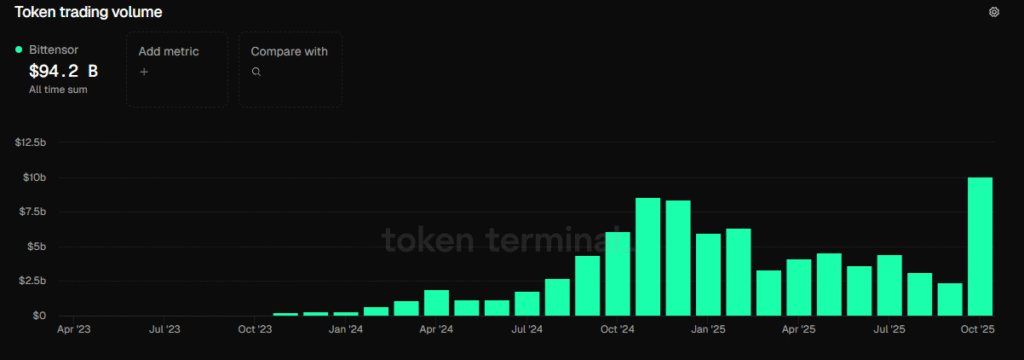

- TAO monthly trading volume rose 31% to $10 billion post-SIX listing.

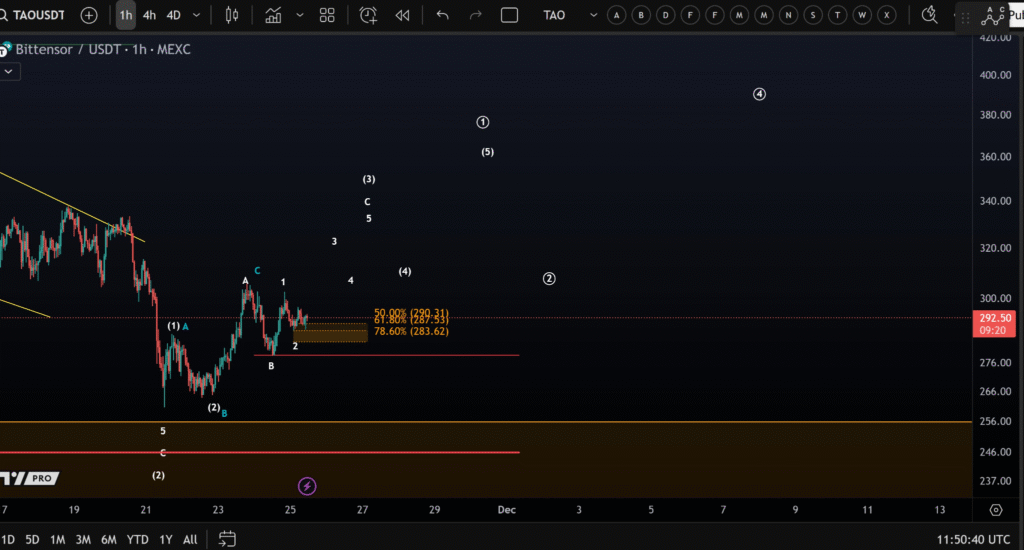

- A potential upside wave structure is forming but remains unconfirmed.

- $278.70 serves as the invalidation point for the current bullish outlook.

Bittensor’s TAO token may be poised for a potential upside reversal, as technical indicators hint at emerging market momentum. Following the recent listing of a TAO ETP on the SIX Swiss Exchange, market interest and volume have surged.

TAO Eyes Reversal as Volume Climbs Following ETP Launch

The TAO token, issued by Bittensor, has seen a rise in trading activity after its exchange-traded product (ETP) launched on the SIX Swiss Exchange. Since the listing, the token’s monthly trading volume has increased by 31%, reaching $10 billion. This increase is linked to growing participation from both retail and institutional traders.

The listing has also improved market liquidity, making TAO more accessible to a wider investor base. This has translated into stronger buying momentum, although traders remain cautious. At the time of writing, TAO is trading near $292.50.

Technical Pattern Suggests Potential Upside, But Confirmation Needed

MoreCrypto continues to track a potential upside move but maintains a cautious view on the reliability of the current wave structure. The depth of the pullback in wave (2) is a key concern, with analysts stating that the pattern lacks impulsive behavior.

The analysis points to a possible development of wave c of (3). However, this cannot be confirmed unless five complete waves form in circle wave 1. If confirmed, this would indicate a diagonal pattern. The invalidation point for the current outlook stands at $278.70. Falling below this would suggest a breakdown of the bullish scenario.

MoreCrypto stated, “The structure is unreliable, because of the depth of the pullback of the larger wave (2) the price might have started wave c of (3), but this structure cannot be seen as reliable until all 5 waves form in circle wave 1.”

Increased Interest Follows Exchange Listing

The timing of the volume increase coincides with the ETP listing, suggesting the event drove new interest. Since going live five days ago, the listing has drawn attention across trading communities and boosted TAO’s exposure in traditional financial markets.

Safello’s listing of the TAO ETP is seen as a key factor contributing to the volume spike. As the token becomes more integrated into broader markets, it may continue attracting more liquidity and price action.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.