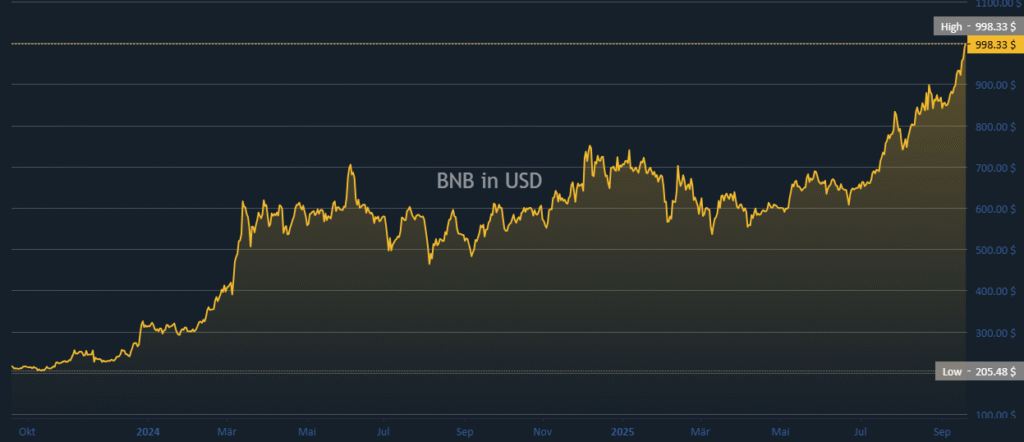

- BNB at $1000 Resistance – Binance Coin’s rally nears the $1000 psychological and technical barrier, a critical level shaping its next move.

- Fibonacci Levels Signal Targets – The 1.618 extension aligns with $998, while the 2.618 extension at $1512 marks the next major target.

- Bullish yet risky structure- Stronger highs and stronger lows will be bullish, but the inability to maintain above 1000 could result in counteractions.

The price of Binance Coin has been on a steep increase with a near-thousand mark, and the most important test awaits the price. The market has a good upward momentum, although the technical indicators indicate some obstacles in the future. The coin remains at an indecisive stage, which may shape its future path.

Break out and Fibonacci Levels.

BNB recently reached $998.33, which is equal to the 1.618 Fibonacci extension, and this is a zone typically associated with short-term rejection or absorption. The second major objective is at 1512, which is the 2.618 Fibonacci extension, which may make or break the turning point. Although the strength of the prices is obvious, technical resistance can create temporary stops before a potential upward movement.

The recent climb builds on weeks of consistent gains, signaling that buyers continue to dominate the trend. Sustained momentum above $1000 would provide confirmation of renewed strength and open space for extended rallies. However, failure to break higher could lead to renewed price consolidation.

The $1000 threshold also carries psychological weight, which could either trigger new buying energy or profit-taking pressure. Price activity around this level will likely set the stage for near-term direction. The outcome could decide whether the market advances toward $1512 or falls back toward lower supports.

Market Structure and Outlook

Longer-term charts show how BNB bottomed near $205 in 2023 before beginning a steady recovery through 2024. A consolidation phase between $500 and $700 established a solid base that fueled the breakout. Momentum gained strength once resistance around $800–$900 gave way.

Source: blockchaincenter

The chart now reflects a bullish structure with higher highs and higher lows forming consistently. The uptrend signals that demand remains strong, but the trend will face serious testing above $1000. The technical setup indicates both opportunity for continuation and risk of correction.

If BNB sustains momentum, the next key resistance is $1512, which would mark a new stage of the rally. However, rejection near current levels could bring pullbacks toward $800 or even $700. The coin stands at a turning point between further expansion and temporary retreat.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.