- BNB hits $890 support, marking its first interaction with the 200-DMA since June 2025.

- Short-term traders face $8.52 million in losses as market volatility rises.

- Binance Coin’s price dip comes amid a strong focus on ecosystem growth.

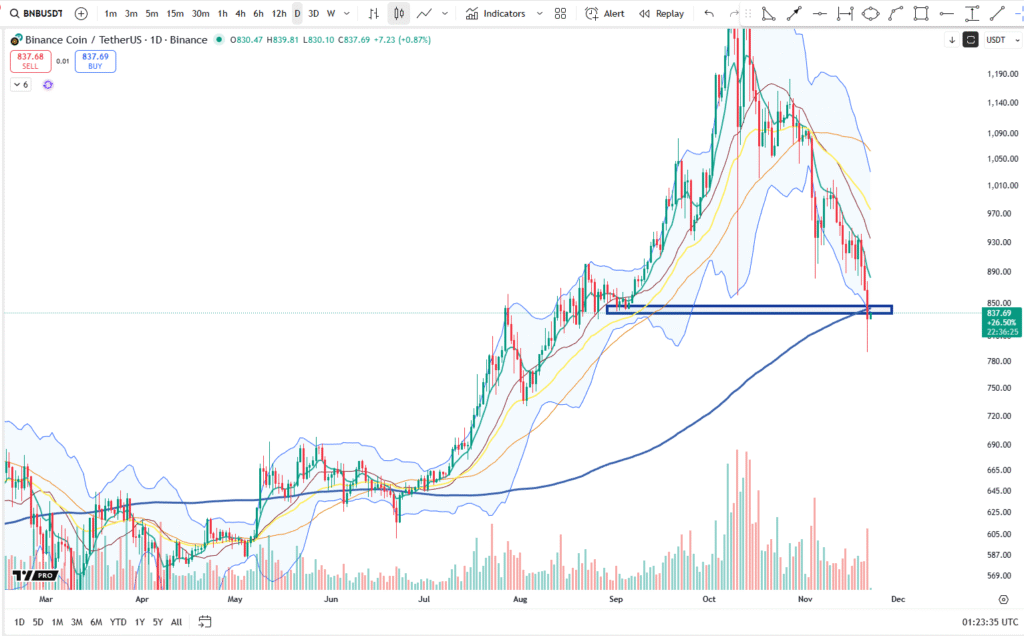

Binance Coin ($BNB) has experienced a sharp drop in value, touching a critical support level of $890. This is the first time BNB has interacted with its 200-day moving average (DMA) since June 2025.

According to analyst BigCheds, the recent price movement reflects broader market volatility and is seen as a potential indication of further bearish momentum. With a significant volume spike accompanying the price drop, traders are closely monitoring the situation for signs of reversal or further downside.

The $890 price level represents a crucial horizontal support zone that has been tested in the past. Historically, these levels are often seen as key indicators of future price action.

If BNB fails to maintain this support, analysts have pointed to potential downside targets of $800 and $690. The market sentiment will largely determine whether these support levels hold or if a deeper decline is expected.

BNB Chain Pushes for Growth Amid Price Decline

Despite the recent price drop, BNB Chain remains focused on long-term growth and ecosystem expansion. The platform has extended its “0 Fee Carnival” initiative until November 30, 2025.

This initiative covers gas fees for transactions using USDC and USD1, aiming to incentivize users to continue interacting with the platform despite the price decline. Binance’s commitment to ecosystem development could provide stability in the long run, even if short-term price action remains volatile.

The “0 Fee Carnival” is seen as a strategic move by BNB Chain to maintain user engagement and grow its user base. While market conditions may affect short-term price movements, the long-term goal remains focused on building a stronger ecosystem.

Increased Liquidations Reflect Market Volatility

Recent data shows a sharp increase in liquidation activity for Binance Coin traders. Within 24 hours, long traders faced significant losses, totaling $8.52 million.

This reflects the heightened volatility in the market, where price fluctuations have caught many investors off guard. Short-term traders, particularly those holding long positions, have been most affected by these price swings.

The growing number of liquidations serves as a reminder of the risks involved in trading during periods of high market uncertainty. As BNB tests key support levels, traders are advised to carefully monitor the market for any signs of further downside or a potential reversal.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.