- BNB confirms breakout above the $780–$800 resistance, setting the stage for a potential move toward $1,300.

- Golden technical setup with short-term moving averages above long-term averages validates sustained bullish momentum across timeframes.

- Intraday strength persists, with support at $900–$910 and $870, while resistance targets rise toward $950, $1,000, and $1,300.

BNB continues to show strong price momentum as technical signals confirm a bullish breakout. The digital asset trades near $925 today. The market outlook points toward a potential rally to $1,300 if current momentum continues without significant setbacks.

BNB has scaled an important resistance that had earlier limited growth to the range of $780 to $800. This breakout reinforces this upward trend and indicates that there is buyer dominance over the longer period. Technical forecasts point out that the next big target for the rally to continue is at 1,300.

The price behavior of the coin establishes a definite breakout after a prolonged period of a long-term consolidation period. Between 2022 and 2023, BNB oscillated without being able to achieve success in increasing its price. The momentum that has been growing since the middle of 2024 is based on the even stronger demand and the steady increase of higher peaks.

Support remains an important factor for sustaining momentum. The $780 and $570 levels provide critical zones that protect the bullish structure if tested. These levels serve as checkpoints against potential pullbacks before continuation.

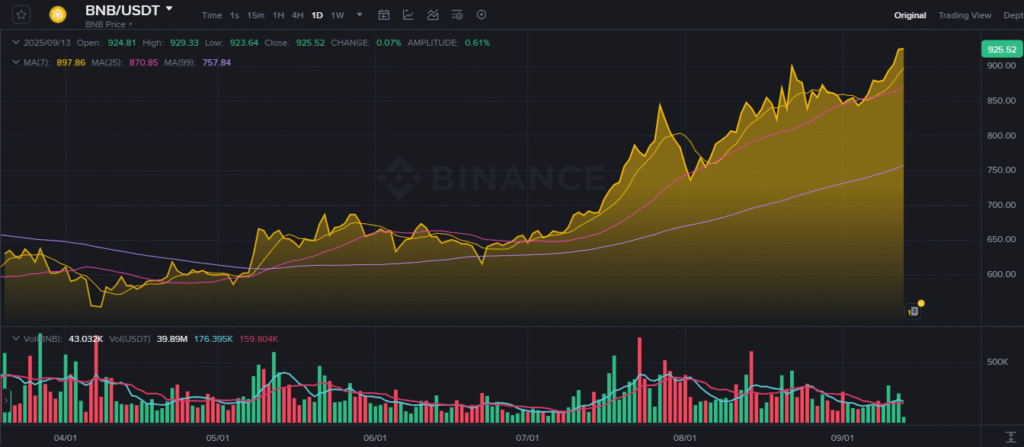

Daily Chart Shows Consistent Strength

The daily price chart of BNB against USDT highlights steady gains since April 2025. Price levels consistently pushed through resistance zones while maintaining higher lows. BNB is now holding near $925 with strong market support.

Source: Binance

Moving averages further strengthen the bullish picture. The 7-day average remains above the 25-day and 99-day averages, creating a strong technical alignment. This golden setup validates momentum on multiple timeframes and signals continuation.

Trading volume adds more confirmation to the rally. Buying spikes during upward moves have supported the breakout through the summer months. Despite a slight decline in recent days, overall activity remains constructive.

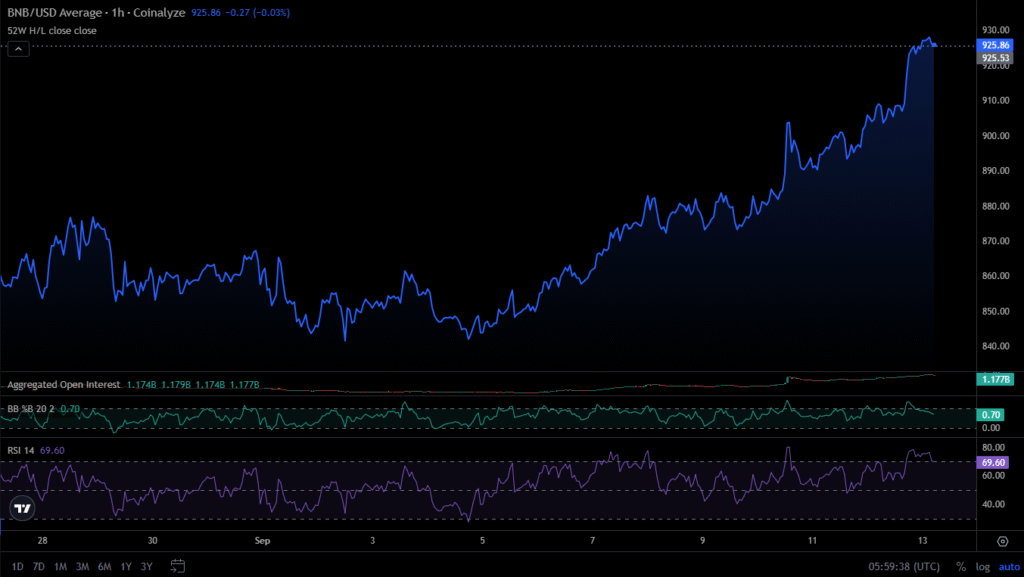

Intraday Momentum Remains Bullish

On the hourly timeframe, BNB shows momentum with price action building above $850–$870 consolidation zone. The rally has accelerated in recent sessions, taking the coin above $920 threshold. Momentum continues to favor further upside movement.

Source Coinalyze

Open interest levels remain steady at approximately 1.177 billion. The stability in market participation suggests positions are being maintained. This supports the bullish move and signals confidence in the rally’s continuation.

Momentum indicators highlight possible near-term pauses. The RSI at 69.60 signals conditions close to overbought, suggesting potential for short pullbacks. However, Bollinger Bands show strong momentum as price rides the upper band.

Outlook

BNB’s immediate support rests near $900–$910, with stronger backing around $870. Holding these levels will preserve the bullish structure. The next resistance sits at $950, serving as a stepping stone toward $1,000 and eventually $1,300.

The alignment across weekly, daily, and intraday charts confirms strong momentum. While short-term consolidation may occur, the broader structure remains upward. BNB’s rally continues to build on strong technical foundations and signals a clear path toward triple-digit gains.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.