- ADA reclaimed $0.7237 support, aligning with key moving averages.

- Fibonacci extensions signal $1.0381 and $1.2014 as next price targets.

- Strong CMF and MFI readings confirm healthy buying pressure levels.

Cardano [ADA] posted a 4.88% gain in the past 24 hours. The altcoin’s daily trading volume surged by 74%. Bitcoin [BTC] continued to face resistance near $117.5K at press time.

Key daily levels and bullish technical structure

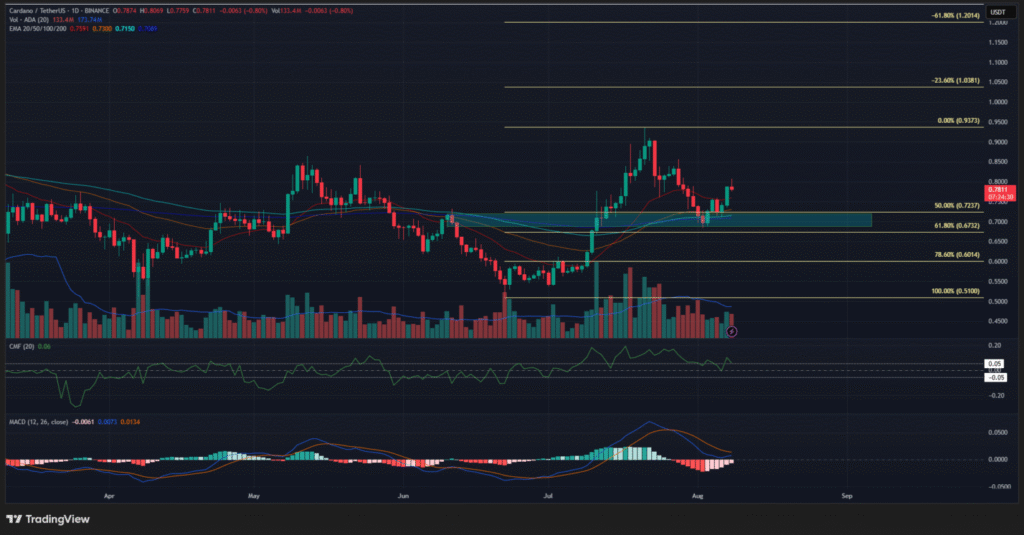

On the 1-day chart from TradingView, Fibonacci retracement levels were plotted from the $0.5100 low in late June to the $0.9373 high in July. The 61.8% retracement sat at $0.6732 and was nearly tested as support during the recent dip. The June peak at $0.7237, a resistance level two months ago, has now been flipped to support.

This reclaimed zone, highlighted in cyan, also aligned with the 20, 50, 100, and 200-day EMAs at $0.7300, $0.7150, and $0.7198, adding further confluence. The Chaikin Money Flow (CMF) stood at +0.06, reflecting steady buying pressure. The MACD indicator remained above zero and was approaching a bullish crossover.

Technical signals on the daily chart pointed to a potential move higher. Fibonacci extension targets at $1.0381 and $1.2014 lined up with previous resistance areas from November to December 2024. A continuation above current levels could open the path toward these targets.

Short-term chart signals strong support

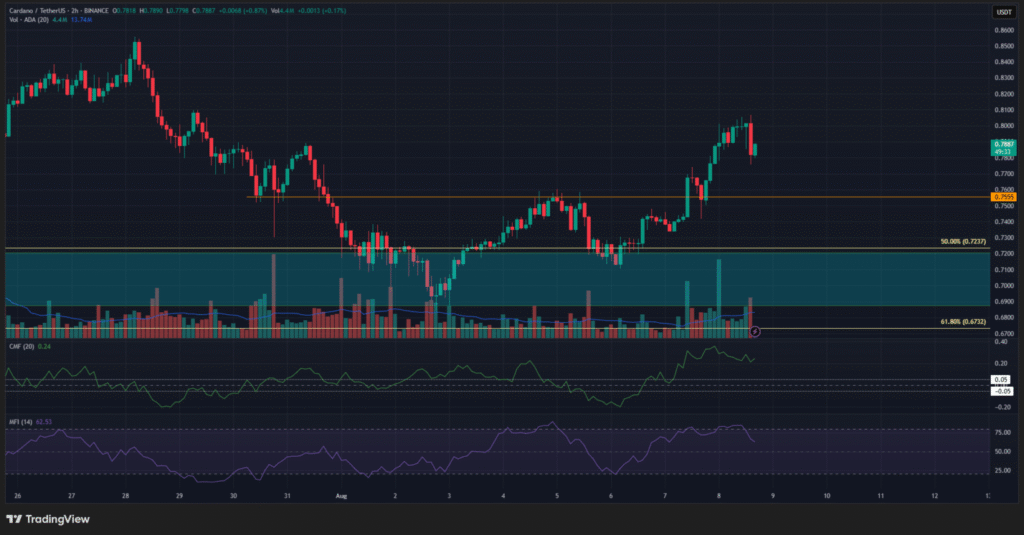

The 2-hour chart placed ADA near $0.7818, where price action had previously encountered resistance during the late July retracement. Bulls appeared to have turned this level into support. The CMF reading of +0.24 indicated strong capital inflows, while the Money Flow Index (MFI) of 62.53 showed active buying without overbought conditions.

Analysts pointed to $0.7555 as the short-term invalidation point for the bullish outlook. Maintaining price action above this threshold could allow ADA to hold momentum toward $0.80, $0.81, and potentially higher resistance zones.

CoinMarketCap data showed ADA trading at $0.8147, up 2.01% on the day, with a market capitalization of $28.86 billion. The 24-hour trading volume was $991.9 million, down 36.31% from the prior day’s surge. Circulating supply stood at 35.42 billion ADA out of a 45 billion maximum.

Price recovered from a daily low of $0.7759, aligning with the bullish technical structure visible on both daily and intraday charts. With the $0.7237–$0.7555 zone acting as a solid base and key Fibonacci extensions pointing to $1.0381 and $1.2014, ADA’s path toward higher levels remains intact.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.