- Cardano (ADA) faces ongoing losses, breaking key resistance levels.

- On-chain activity shows rising network usage, suggesting potential demand.

- ADA tests critical support between $0.322 and $0.437, awaiting confirmation of a reversal.

Cardano (ADA) continues to face challenges, with its price extending losses by 5% to $0.4226 at press time. This follows a 3% decline the previous day, with the cryptocurrency breaking through its local resistance trendline.

Market sentiment is turning increasingly bearish, driven by the broader market’s response to the US Federal Reserve’s hawkish quarter-point rate cut. In addition, derivatives data reveal a significant shift, with both Open Interest and active long positions declining.

Despite the negative sentiment, on-chain data shows a surge in network activity, signalling potential long-term support for Cardano. While this may indicate increasing demand, ADA is still at risk of further losses in the short term.

Technical Analysis: Testing Key Support Levels

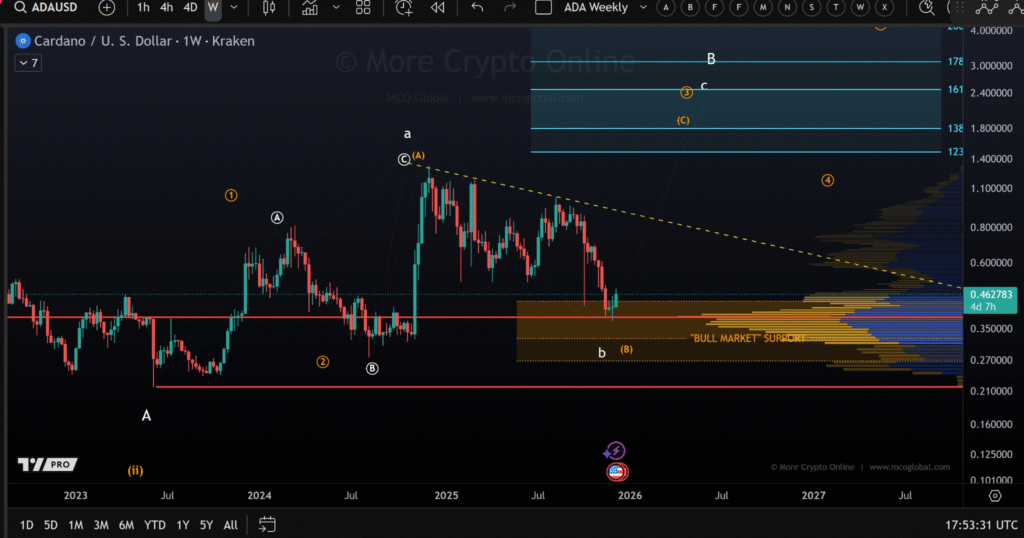

Analyst MoreCryptoOnline highlights the critical support range that ADA is currently testing. The asset is trading within a broad support band between $0.322 and $0.437.

This region holds key Fibonacci support, which could help stabilise the price if ADA continues to test these levels. However, a strong reaction at the Point of Control, but it is still too early to confirm if this marks a long-term low for ADA.

The next focus will be on whether ADA can form a five-wave impulse upward, which would signal a completed bottom and potential reversal.

Positive Outlook from Some Analysts

While some analysts remain bearish, others see a more optimistic outlook for Cardano. Trader Luciano_BTC suggests that ADA is currently within a demand zone following a downtrend.

Based on price action and technical indicators, Lucky believes that ADA is poised for a breakout from the descending channel. If the breakout occurs, ADA could rise again in the coming months, potentially reaching new highs by early 2026.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.