- Long-to-short ratio for ADA drops below one, showing bearish positioning.

- RSI and AO confirm increased selling pressure as support gets tested.

Cardano (ADA) continues to face increased bearish sentiment as key indicators suggest downward pressure remains dominant. The token has recorded a 3.43% dip in the past 24 hours, trading at $0.6802.

Coinglass recent data shows a persistent bearish trend in Cardano’s derivatives market. The open interest (OI)-weighted funding rate has hovered near zero with frequent dips into negative territory since early March. This pattern suggests that long positions are weakening as traders hesitate to bet on price recovery.

In addition, the long-to-short ratio for ADA has dropped to 0.84, the lowest level in over a month. This shift indicates more traders are entering short positions, expecting further declines.

A ratio below one reflects bearish market sentiment and increased caution among market participants. These trends are aligning with the broader decline in crypto markets, intensifying the pressure on ADA.

Technical Indicators Show Momentum Favoring Bears

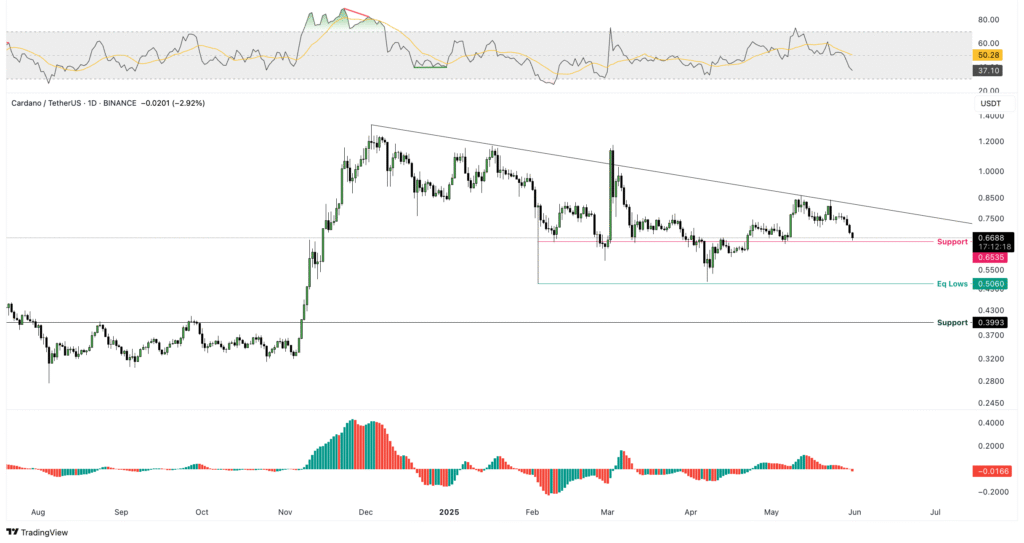

Cardano’s price has declined by 22% since May 23, 2025, bringing it closer to the critical $0.653 support zone. According to analysts, this level has held firm four times over the past four months. However, the token has been forming a series of lower highs since peaking at $1.326 on December 2, 2024.

Technical signals further support the bearish outlook. The Relative Strength Index (RSI) has dropped below 50, indicating that selling pressure is outpacing buying interest.

Meanwhile, the Awesome Oscillator (AO) has shown consecutive red bars below zero, suggesting sustained bearish momentum. If ADA fails to hold the $0.653 level, analysts warn that the token could fall by another 30% toward the $0.506 liquidity zone.

Descending Channel Limits Upside Movement

ADA remains confined within a descending channel, which has shaped its price action throughout early 2025. Crypto analyst Ali Martinez has noted that the token is currently trading around $0.755, approaching the upper boundary of this downward-sloping range.

Martinez emphasized that a breakout above the $0.79 resistance level could mark a key reversal point. A successful move above this threshold may shift sentiment and potentially open the door to a recovery.

However, until ADA breaks out of the channel, the market remains bearish. Traders are closely watching price activity near $0.79 to assess whether ADA can escape its current downtrend.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.