- Cardano (ADA) price currently consolidates between $0.80 and $0.90 with RSI at 53.69.

- ADA faces key resistance at $0.90 and potential support at $0.80.

- A breakout above $0.90 could lead Cardano toward the $1 target.

Cardano (ADA) has been trading around $0.8729, with the price testing a crucial resistance level just below $0.90. The price has been consolidating between $0.80 and $0.90 since March 2023, signaling the possibility of a breakout in either direction.

The Daily Chart: Consolidation and Resistance Levels

On the daily chart, ADA has consistently failed to break the $0.90 resistance level, which has become a key hurdle for the bulls. Despite multiple attempts to surpass this price point, the price has retraced, signaling that there is strong selling pressure at these levels. The current price action suggests a consolidation phase, with ADA trading between $0.80 and $0.90 for the past several months.

The RSI reading of 53.69 indicates a neutral market, with no clear dominance from the bulls or bears. This range-bound price action could indicate that ADA is awaiting a catalyst to break out of its consolidation.

A break above the $0.90 resistance could trigger a bullish rally toward the $1 mark. However, failure to break this resistance may lead to a further pullback, with the $0.80 support level being the next critical zone to watch. Traders are focused on ADA’s ability to either sustain above $0.90 or fall back to lower levels, as this will determine the next move in ADA’s price.

The 4-Hour Chart: Short-Term Bearish Bias

On the 4-hour chart, ADA is currently trading at $0.8725, showing a slight decline of 1.14% in the last four hours. The price is facing resistance around the $0.90 level, with support near $0.85.

The Relative Strength Index (RSI) on the 4-hour chart is at 41.99, indicating a bearish sentiment as ADA approaches the oversold zone. This suggests that further downward pressure could occur if ADA fails to hold above the $0.85 support level.

If ADA manages to hold above the $0.85 level and break through the $0.90 resistance, it could trigger a bullish trend in the short term. However, if the price fails to reclaim $0.90, further declines could be expected, with potential support levels forming at lower price points.

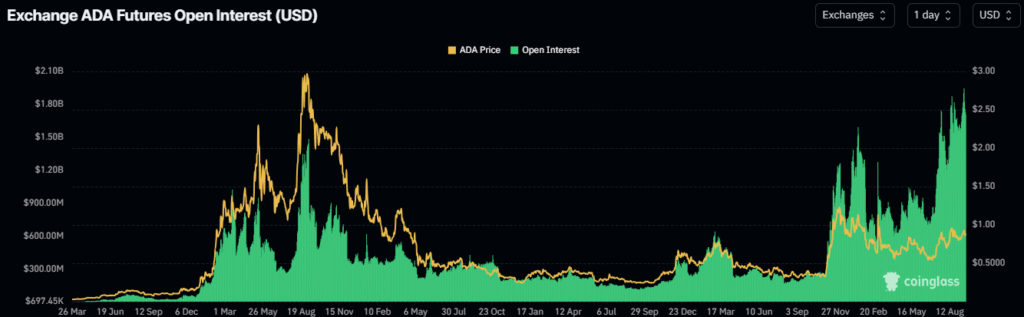

Open Interest Correlation with ADA’s Price Movement

Looking at Cardano’s open interest in futures contracts reveals a significant correlation between ADA’s price movements and the level of investor activity. The open interest surged notably in April and May 2023, corresponding with a price rally.

This suggests that increased futures market sentiment can amplify ADA’s price volatility. The largest spike in open interest coincided with ADA’s price peak in mid-2023, showing that the futures market’s sentiment often mirrors the price action. Traders continue to watch open interest as a leading indicator of ADA’s price movement.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.