- LINK trades inside $5.60–$7.64 bullish order block with HTF confluence

- Breakout and retest from 2021 channel supports long-term accumulation

- Weekly close below $4.84 invalidates bullish outlook and target zones

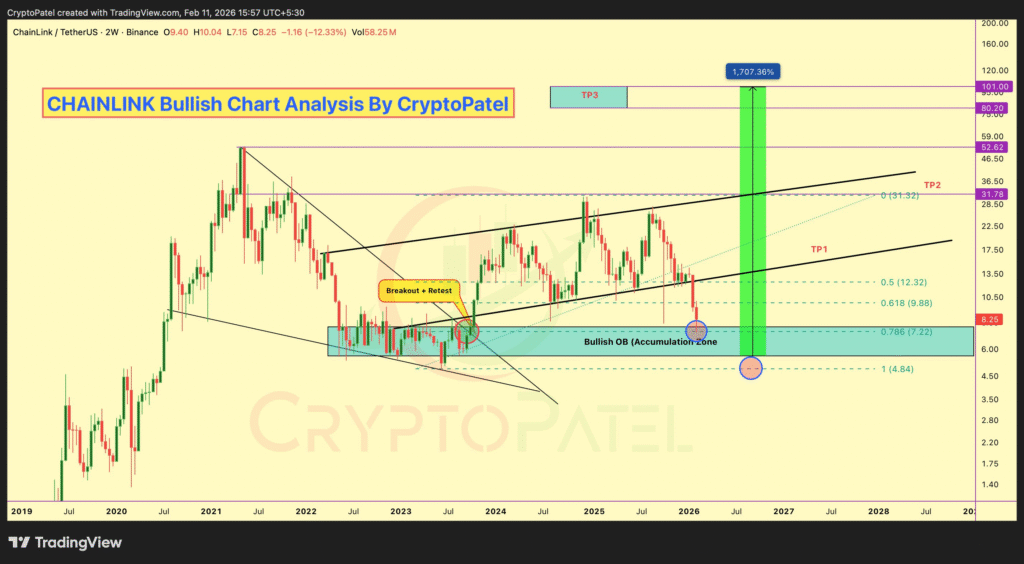

Chainlink (LINK) is currently trading between $5.60 and $7.64 within a high-confluence long-term bullish zone. A breakout and retest from the 2021 descending structure has formed the basis for a projected multi-stage upside.

Chainlink Holds Accumulation Zone Between $5.60 and $7.64

Chainlink (LINK) is currently trading within a major long-term accumulation range defined by a bullish order block from $5.60 to $7.64. Analyst CryptoPatel shared this technical setup based on high time frame (HTF) indicators and a breakout structure.

According to the analysis, LINK has broken out of a 2021 descending channel and successfully retested the breakout zone. The 0.786 Fibonacci level at $7.22 is identified as the preferred entry level. This zone aligns with multiple technical factors, including demand structure and historical support.

Upside Targets Set While Key Support Defines Bullish Thesis

CryptoPatel noted that the bullish outlook remains valid as long as LINK holds above $5. If the weekly close breaks below $4.84, the bullish view would be invalidated. The setup also includes upside targets at $12, $31, $52, and $100, supported by Fibonacci extensions and prior resistance levels.

The analysis further points to a classic structure involving a breakdown and liquidity grab before the price returned to the order block. The accumulation began within three months of the spot ETF launch, with roughly $70 million in total assets under management reported during that period.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.