- Chainlink’s price faces potential drop to $18 if bearish trends continue.

- Chainlink’s TVS hits a new record, reflecting growing market adoption.

- Chainlink’s long-term growth is fueled by real-world asset tokenization.

Chainlink ($LINK) may be on the verge of a deeper price correction. Crypto analyst Ali Martinez has raised concerns that LINK could drop to $18 if recent bullish moves turn out to be false signals.

Chainlink has recently faced a rejection near the upper boundary of a descending parallel channel at $23.50. This technical pattern suggests that the token might not have enough bullish momentum to break higher.

Instead, analysts predict that if the downward trend continues, LINK could fall toward the $18 level, where the lower channel support lies. Such a price movement would mark a deeper correction for the asset, indicating further selling pressure in the short term.

Chainlink’s On-Chain Metrics Show Positive Growth

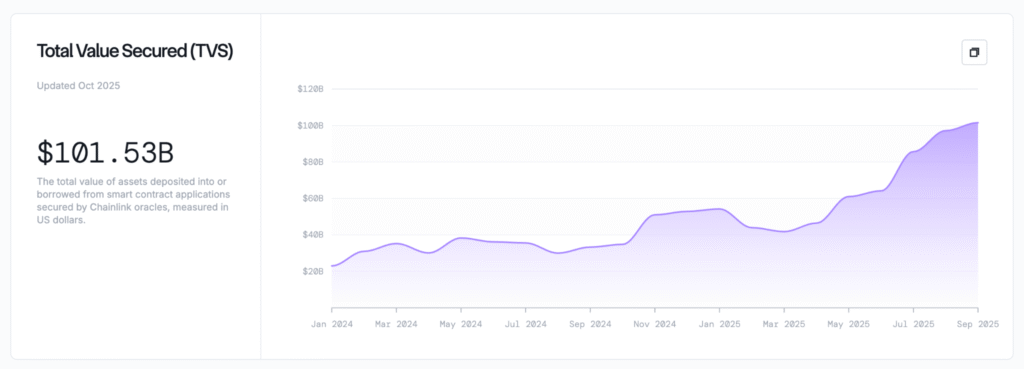

Despite the potential short-term risks, Chainlink’s on-chain metrics continue to show positive growth. In September, the project’s Total Value Secured (TVS) reached a new all-time high of $101.5 billion. TVS is a key indicator of the total value of assets secured by Chainlink’s smart contracts, and this increase highlights the growing adoption of its decentralized oracle solutions.

Moreover, Chainlink’s influence is expanding as it plays a pivotal role in the tokenization of real-world assets (RWAs). Large financial institutions such as BlackRock are actively involved in this space, further boosting the demand for Chainlink’s services. These developments suggest that Chainlink has a strong foundation for long-term growth, even in the face of short-term price fluctuations.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.