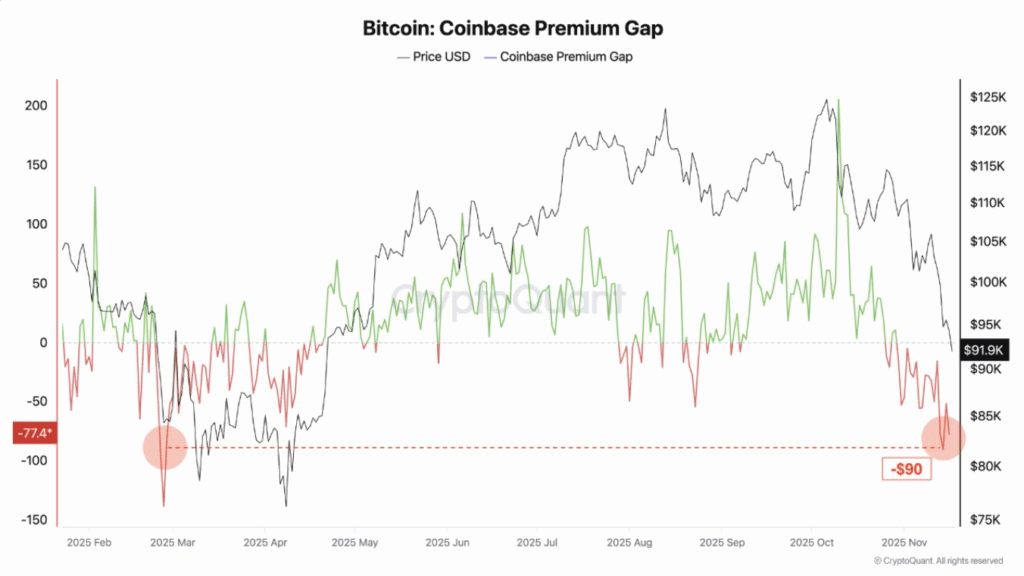

- Coinbase Premium Gap at -$90 means Bitcoin trades cheaper on Coinbase than Binance today.

- Retail traders on Binance set recent price direction, but US demand stays low.

- Gap hit similar low of -$138 in February 2025 when institutions cut activity.

Bitcoin’s Coinbase Premium Gap dropped to -$90 on November 19, 2025, reflecting a decrease in demand from US investors. The gap measures the price difference between Bitcoin on Coinbase (USD pairs) and Binance (USDT pairs).

A negative gap suggests that Bitcoin is trading for a lower price on Coinbase compared to Binance, often due to reduced institutional buying. This shift typically signals weaker interest from US-based traders, particularly institutions.

Retail Traders Drive the Market, Leaving Institutions on the Sidelines

The current negative gap is a sign that retail traders, who are more reactive to short-term news, have taken control of the market. With the price of Bitcoin dipping slightly below $90,000 before recovering to the $91,000-$93,000 range, the market has seen less activity from larger institutional investors.

CryptoQuant analysts explained, “The current sharp negative gap means that recent price movements are being driven primarily by retail traders on Binance, while institutions appear to be hedging, trimming exposure, or remaining inactive.”

Typically, when institutions are active, Bitcoin tends to be more expensive on Coinbase due to their higher buying prices.

However, this trend has reversed as institutions appear to have paused their positions. As a result, Bitcoin’s price has become cheaper on Coinbase compared to Binance, which has a larger global retail audience.

Past Trends and Market Outlook

The negative gap is not unprecedented. A similar drop occurred in February 2025 when the gap reached -$138, but the market eventually stabilized.

The gap’s current level, at -$90, suggests that while retail trading is driving recent price changes, it is uncertain whether this trend will continue. Traders will be closely monitoring the gap to see if institutional interest returns, which could shift the market dynamics once again.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.