- Injective’s Wave 3 could push $INJ price to $100, offering a 217% upside.

- Pineapple Financial’s $100 million investment marks Injective’s broader market entry.

- Analysts are watching Injective closely for momentum in the current bull market.

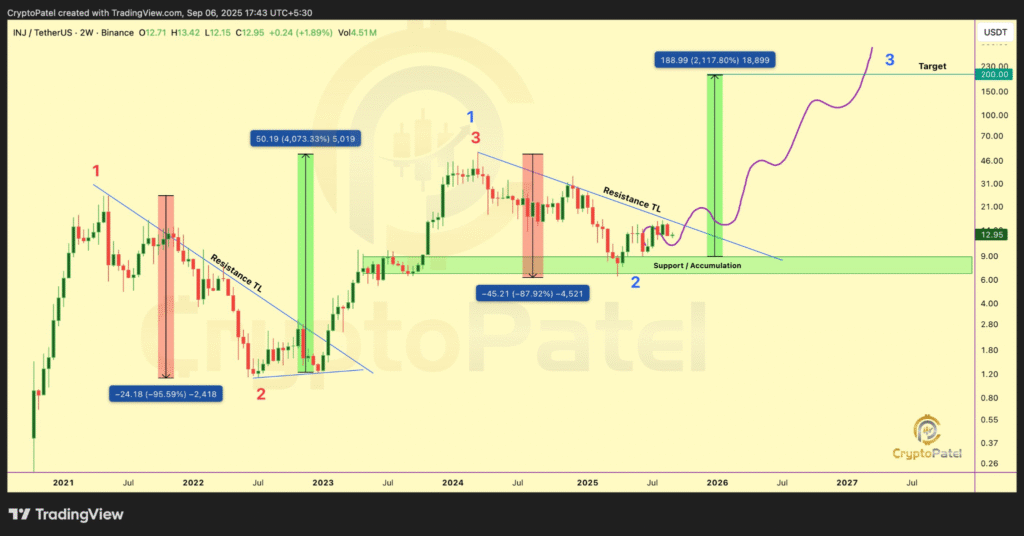

Crypto analyst Crypto Patel has forecasted a significant price surge for Injective ($INJ) in the current bull market. The analyst believes the cryptocurrency is on the cusp of a breakout, driven by a clear Elliott Wave pattern forming on the chart.

According to Patel, the completion of Wave 2 near the $6–$7 support zone has set the stage for a potential Wave 3 rally. Wave 3, a key phase in the Elliott Wave theory, could lead to substantial price growth, with targets projected between $100 and $180 for $INJ, offering a potential upside of 217% from current levels.

Investors are particularly attentive to whether $INJ can sustain the support levels it has recently tested. If the pattern holds, and a similar breakout occurs to the one seen in 2022 when $INJ surged over 600%, the cryptocurrency could experience a strong rally in the near future.

Pineapple Financial’s Entry Marks a New Stage for Injective

The Injective ecosystem has recently expanded with Pineapple Financial’s introduction to the traditional finance sector. Pineapple Financial, a publicly traded digital asset company, operates under the ticker PAPL.

On September 5, it appeared across Bloomberg Terminals, signaling a crucial step for Injective’s broader integration into mainstream financial markets. The company has begun its operations with $100 million in capital, which it considers just a starting point.

Pineapple Financial’s decision to list on the Bloomberg Terminal opens the door for institutional investors to access Injective-linked assets, marking an important transition from purely crypto-native channels to more traditional finance avenues.

What’s Next for Injective ($INJ)?

In the next wave in the injective ecosystem, attention is focused on whether $INJ can repeat past cycles and break through key resistance levels. If the anticipated Wave 3 rally takes place, $INJ could see substantial price movement in the coming months.

With Pineapple Financial’s new listing and $INJ’s strong technical patterns, the outlook appears positive. The broader crypto market’s bullish momentum may provide the necessary catalyst for this growth. The next few weeks will be critical in determining if Injective can reach its projected target of $100 in this cycle.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.