- Stablecoin growth slows despite $7B surge – August saw reserves expand sharply, but the pace of inflows lags previous cycles.

- Tether’s growth moderates – USDT’s 60-day expansion holds near $10B, far below its earlier $21B peaks.

- Liquidity moderation signals cooling momentum – Slower inflows suggest steadier conditions, limiting immediate fuel for major crypto rallies.

Stablecoin reserves on exchanges expanded by $7 billion this August, but crypto liquidity cools as stablecoin growth slips below trend. The shift highlights a slower pace of capital inflows compared with previous cycles. Market data indicates that liquidity remains present, yet momentum appears weaker than earlier in the year.

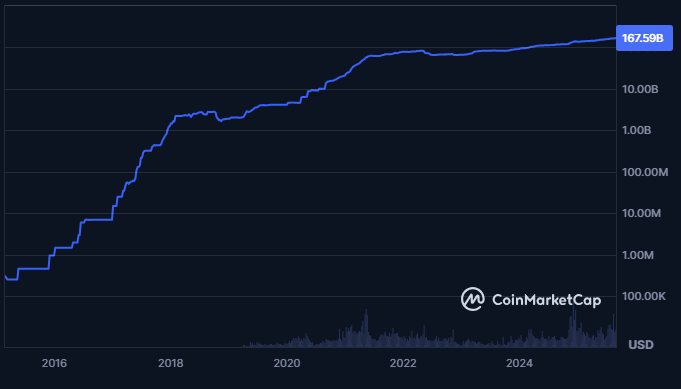

Tether (USDT)

Tether remains the largest stablecoin, but its growth has moderated sharply in recent months. The 60-day expansion of USDT holds near $10 billion, well below the $21 billion peaks of earlier cycles. Analysts note that this confirms how crypto liquidity cools as stablecoin growth slips below trend.

The latest trend shows issuance dropping slightly under moving averages. This points to slower inflows rather than any meaningful contraction. Market participants continue to hold reserves, but the pace of new issuance appears to weaken steadily.

Despite this moderation, Tether still supports overall exchange liquidity. However, the reduced rate of growth signals a more tempered supply environment. This ongoing adjustment underlines again that crypto liquidity cools as stablecoin growth slips below trend.

Aggregate Stablecoins

Broader stablecoin capitalization has also shown weaker expansion across exchanges. Weekly inflows now average around $1.1 billion, compared with $4–8 billion in late 2024. The figures demonstrate clearly how crypto liquidity cools as stablecoin growth slips below trend.

The slowdown reflects a market shift from rapid issuance toward steadier conditions. Capital remains in the system, but without the earlier acceleration. Market cycles often hinge on liquidity speed, and this moderation could weigh on future rallies.

Historical data links stronger stablecoin expansion with Bitcoin’s upward phases. Conversely, weaker inflows reduce immediate fuel for major breakouts. The present trend confirms again that crypto liquidity cools as stablecoin growth slips below trend.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.