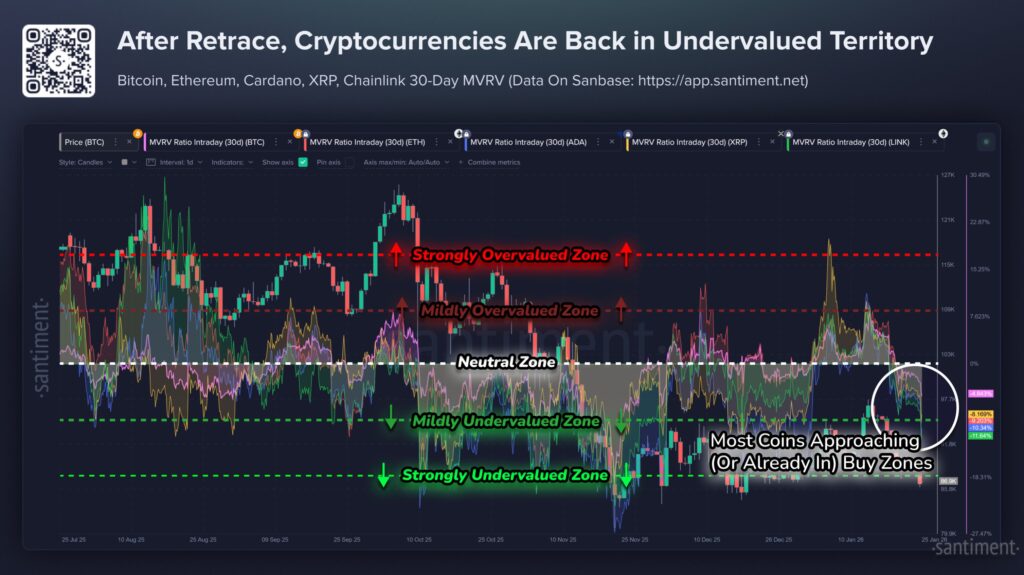

- Chainlink leads major assets with a negative 30-day MVRV reading of 9.5 percent.

- Ethereum Cardano and XRP also trade below average trader cost levels.

- Bitcoin shows mild undervaluation with a 30-day MVRV near minus 3.7%

Crypto markets are showing signs of reduced downside risk, according to new on-chain data. Santiment reports that several large digital assets are trading below average cost levels. The findings are based on the 30 day Market Value to Realized Value metric.

Santiment explains that MVRV compares current prices with realized prices of recent traders. Negative values suggest that average holders are sitting on unrealized losses. Positive values indicate unrealized profits and higher entry risk for new positions.

Major Altcoins Show Deeper Negative MVRV Levels

Santiment data shows Chainlink holding a 30 day MVRV of negative 9.5%. This places the asset among the most undervalued in the current sample. Cardano follows with a minus 7.9% reading over the same period.

Ethereum also records a negative MVRV of minus 7.6 percent. XRP is down 5.7% according to Santiment’s chart. Santiment states that “the more negative the MVRV, the lower the average trader profit.”

Bitcoin Holds Mildly Undervalued Position

Bitcoin shows a 30 day MVRV of minus 3.7%. Santiment classifies this level as mildly undervalued compared to historical norms. The data suggests that recent Bitcoin buyers remain slightly below break even levels.

Santiment notes that positive MVRV levels raise caution for new entries. Higher values show that average traders hold unrealized gains. The firm provides a live chart to monitor MVRV changes across major assets.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.