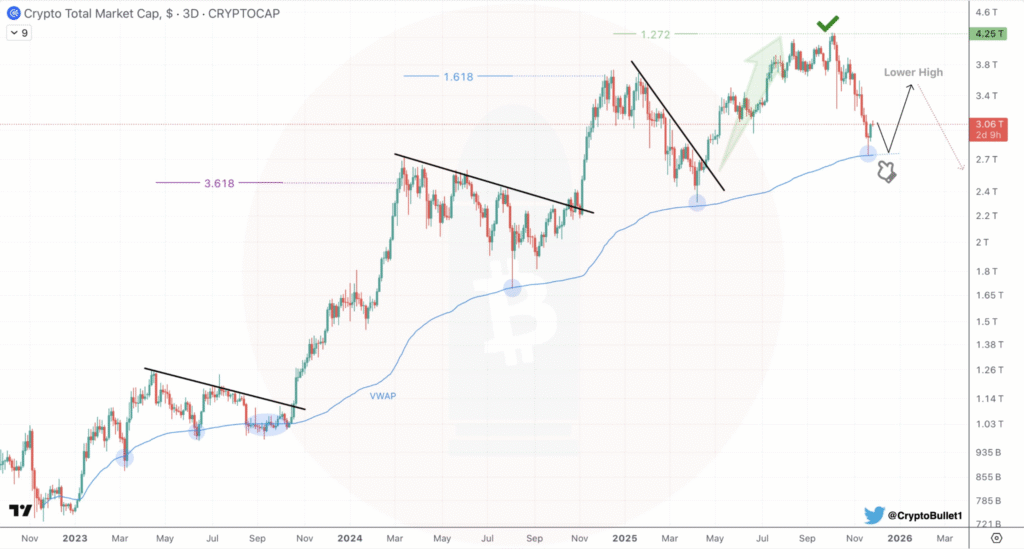

- Crypto Total Market Cap reached its target in October, now testing VWAP for potential short-term bounce.

- A short-term rally could occur, but a drop below VWAP is expected around 2026.

- December may bring another VWAP test before a larger move in the crypto market.

The crypto market is currently going through an important phase, with the total market capitalization approaching several key levels that could dictate its future movement. In October, the market hit a target as predicted by analysts, signaling a potential shift in trends.

December Testing and Anticipated Short-Term Rally

In December, the crypto market may see another test of the VWAP, a crucial indicator for traders. According to recent analysis by CryptoBullet, this could trigger a brief rally, which would be a lower high compared to the peak seen earlier in the year.

This movement suggests that the market may briefly rebound before facing a more significant downturn. Analysts are closely monitoring this level to assess whether the VWAP can hold as support or if the market will continue to weaken.

The expectation is that this potential rally will only last for a short period, and it is believed that a decline may follow soon after.

Long-Term Forecast and Potential Break Below VWAP

Looking further ahead, experts believe the market may break below the VWAP in 2026, marking a key turning point in the overall trend. A drop below the VWAP could signal a larger correction or shift in market sentiment.

This is expected to occur after a possible dead cat bounce in the coming months, as indicated by current market analysis. However, the short-term outlook remains positive, with expectations of some relief in the next few months.

While the market could test the VWAP once more, it is not likely to hold indefinitely. Therefore, while the market may experience some upward momentum, the long-term trend points to potential weakness after the final tests of 2025 and early 2026.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.