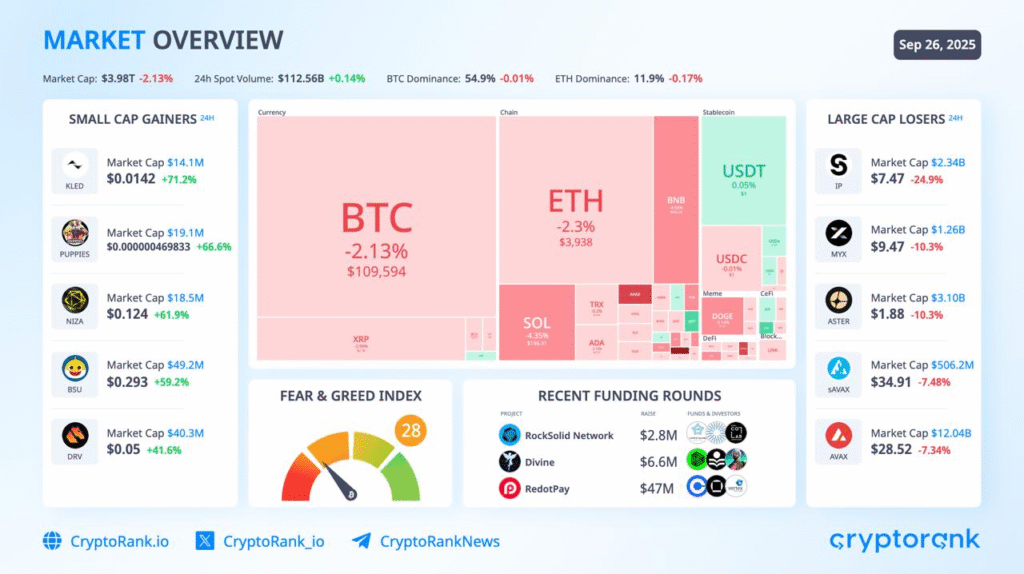

- Bitcoin and Ethereum see losses as ETFs face outflows for three days straight.

- The total crypto market cap drops to $3.98 trillion, reflecting ongoing volatility.

- Small-cap tokens like KLEO and PUPPIES gain traction amid broader market decline.

The cryptocurrency market is currently in a downturn, with Bitcoin ($BTC) and Ethereum ($ETH) facing significant price drops. According to data from CryptoRank.io, Bitcoin is trading at $109,594, down 2.13%, while Ethereum is at $3,938, reflecting a 2.30% decrease.

These declines have resulted in nearly $1 billion in liquidations across the market. With the total market capitalization now at $3.98 trillion, the market sentiment is marked by fear, as the Fear & Greed Index (FGI) sits at 28, signaling a period of uncertainty.

ETF outflows have also contributed to the bearish trend. Bitcoin and Ethereum ETFs have seen outflows for three consecutive days, reflecting a cautious stance among investors. In contrast to the declines in major cryptocurrencies, smaller tokens like KLEO and PUPPIES have posted gains, with KLEO up by 17.2%.

Liquidations Reflect Ongoing Volatility

CryptoRank.io reports reveal that liquidations have surged to $968 million, indicating the high level of volatility in the cryptocurrency market. These liquidations typically occur when traders are forced to sell positions due to price fluctuations.

This is common during periods of sharp market movement, particularly when major cryptocurrencies like Bitcoin and Ethereum break key support levels.

The market’s uncertainty is compounded by the fact that these liquidations are not isolated events but part of a larger trend. Many are choosing to exit positions, which adds to the downward pressure on prices.

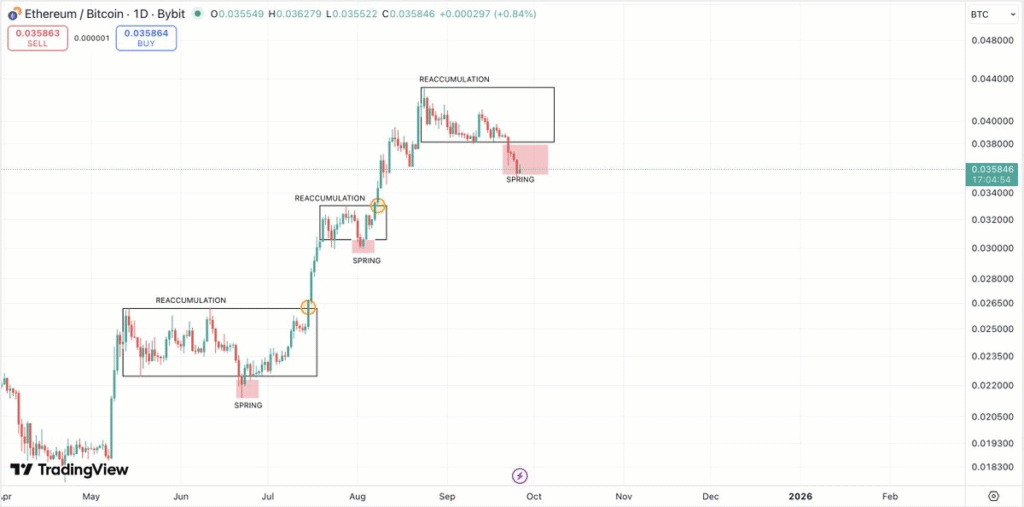

Ethereum/Bitcoin Pair Shows Signs of Reaccumulation

The Ethereum/Bitcoin (ETH/BTC) pair has experienced notable fluctuations, with a series of “Spring” and “Reaccumulation” phases over the past year. These patterns suggest that while both cryptocurrencies have seen price drops, they are undergoing consolidation.

After a strong price rise in the first half of 2023, Ethereum entered periods of reaccumulation, often followed by brief dips known as “Spring” phases.

Currently, Ethereum is in the middle of another “Spring” phase, testing lower price levels. The ETH/BTC pair is attempting to stabilize near the 0.0358 level. This pattern suggests that the market could be preparing for another phase of accumulation, potentially setting the stage for an upward breakout if these price levels hold.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.