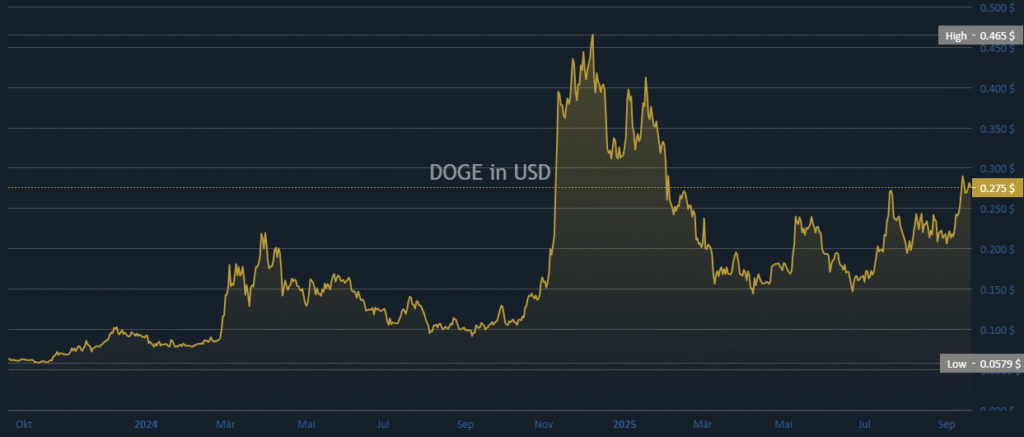

- Critical Resistance at $0.29 – Dogecoin’s repeated rejection at $0.29 highlights a key barrier that could define its next trend.

- Targets at $0.36 and $0.45 – A breakout could trigger rapid upward moves toward higher resistance zones shaped by past consolidations.

- Volatility Dominates Structure – DOGE’s market cycles of rallies, corrections, and recovery attempts confirm its unpredictable yet active trading behavior.

Dogecoin trades near the $0.275 mark after a sharp rebound, but strong resistance around $0.29 defines the next direction. The price shows renewed energy, yet traders face uncertainty as support and resistance levels remain decisive. The coin now stands at a critical stage between potential breakout and breakdown.

Support and Resistance Levels

Dogecoin has tested $0.29 several times, but each attempt has triggered selling pressure and a quick rejection. The barrier remains strong, but a decisive break could transform it into reliable support. Sustained momentum above this level would open the path to higher targets.

Price charts highlight resistance at $0.36 and $0.45, both levels shaped by previous market consolidations and reversals. These zones could attract selling pressure, while they also serve as potential profit-taking points. Traders anticipate movement across these points with increased volume.

Support lies around $0.20, which has previously absorbed heavy selling and created a base for recovery. If resistance holds, price may return to this area. The trading range remains active, and volatility continues to dominate short-term action.

Long-Term Trend and Market Structure

Dogecoin surged above $0.40 in early 2025 after a steady climb from under $0.10 in early 2024. The strong rally displayed speculative momentum, but sharp corrections soon followed, erasing large portions of the gains. Prices eventually stabilized after dropping below $0.20 mid-year.

Source: blockchaincenter

Current market structure signals attempts to rebuild, with higher lows appearing since mid-2025. This pattern suggests recovery, though resistance has not yet given way. Buyers continue testing, but the outcome remains uncertain.

Broader sentiment reflects the typical cycle of sharp rallies, corrections, and consolidation. Price swings show both enthusiasm and fatigue within the market. Dogecoin’s volatility ensures rapid shifts between gains and losses.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.