- Dogecoin has emerged out of a symmetrical triangle, one of the classic bullish patterns, which is an indication of a possible change in trends.

- The 0.06-0.07 range is no longer a crucial support zone; being above it would preserve the bullish momentum.

- A breakout of over 0.09 would seal an opportunity to further growth, which would solidify the bullish arguments of Dogecoin.

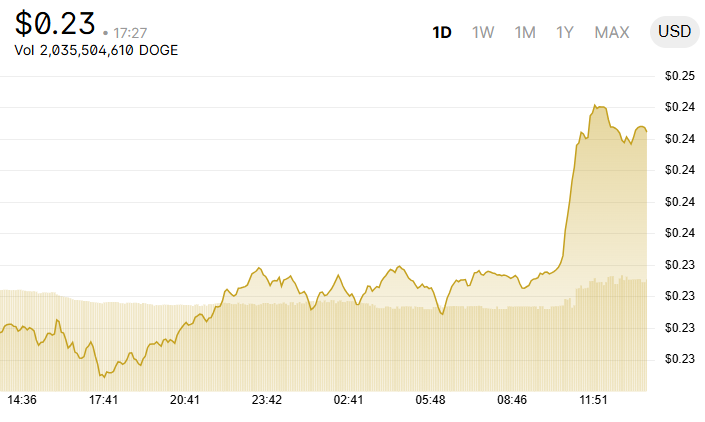

Dogecoin recovered its price following a breakout of a consolidation tendency and re-entered to test its support zone. The coin moved higher in recent sessions, confirming strength after months of sideways trade. Analysts now observe whether the breakout retest will hold and open the way for further momentum.

Price Action Context

Dogecoin moved from a period of decline in late 2022 into an extended accumulation phase during much of 2023. The coin broke out of this long sideways structure and reached higher levels before retracing back. This movement brought the price toward its earlier breakout area, which has become a key test zone.

The breakout structure highlighted a symmetrical triangle, which often reflects compressed volatility before a decisive shift. Dogecoin exited the formation to the upside, showing signs of renewed bullish energy. However, the subsequent pullback lowered the price close to the earlier breakout point.

The latest action underscores the importance of the $0.06 to $0.07 region, which now stands as significant technical support. A sustained hold above this level could confirm the validity of the earlier breakout. By contrast, a return below the zone may weaken the momentum gained earlier in the year.

Support and Resistance Levels

The $0.06 to $0.07 range now acts as a support base, while immediate resistance stands at $0.08 to $0.09. A decisive move above resistance could trigger further upside and extend the bullish case. Failure to advance beyond resistance may limit momentum and push the coin back into consolidation.

Source: blockchain.com

The retest phase plays an important role in determining the continuation of the upward trend. The market tends to validate breakouts when prices revisit and hold previous levels. This stage now decides whether Dogecoin sustains strength or loses ground to renewed selling pressure.

The $0.08 to $0.09 ceiling remains the immediate obstacle before the coin targets higher territory. Market participants consider this range crucial for any sustained uptrend. Breaking beyond it may set the stage for fresh moves above prior yearly highs.

Market Outlook

The caption “Higher” reflects expectations of upward continuation following the breakout and retest process. This pattern often precedes trend resumption when price behavior aligns with technical rules. Dogecoin now stands at a pivotal level in its market structure.

Sustaining strength above support can maintain confidence in the breakout and prepare the ground for further bullish progress. The technical case favors continuation if the coin avoids a breakdown into its former consolidation. This scenario would confirm that the prior base now acts as solid ground.

In contrast, a retreat into the triangle could signal a loss of momentum and delay any extended recovery. Market conditions remain dependent on whether support levels hold during the current retest phase. The outcome will decide if Dogecoin sustains its advance or reverts to a neutral path.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.