- Dogecoin’s consistent rise to $0.19724 reflects strong bullish momentum, as the coin sustains gains above key support levels.

- Despite a 37.43% year-to-date decline, DOGE shows signs of recovery with 4.68% weekly and 8.43% six-month growth.

- Dogecoin’s consolidation above $0.19 establishes a firm base for continued price stability and potential upside movement.

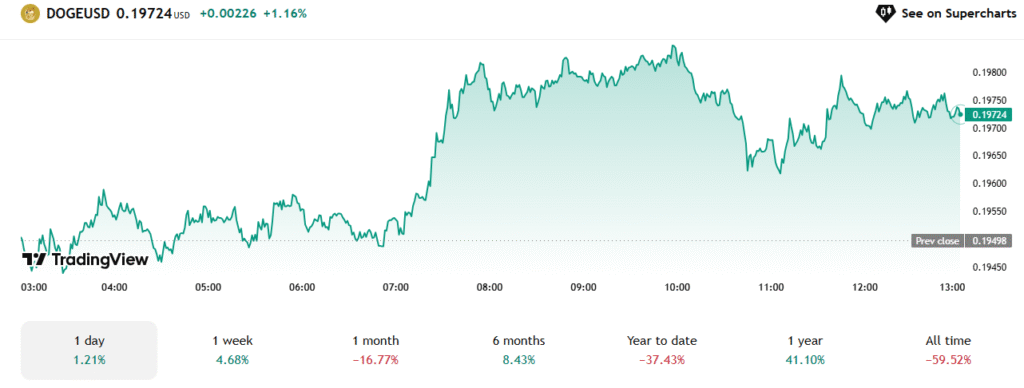

Dogecoin showed a great bullish movement as its value increased 1.16 percent in the last 24 hours to reach to the value of $0.19724. The increase was following a steady intraday recovery that implied better market participation and renewed purchasing interest. In addition, the coin had been experiencing an upward pressure during the session, and it was an indication of gradual recovery.

This optimistic pace was speeds up as after 07:00, DOGE crossed the past levels of resistance and hit a high of about $0.198. The trend was a signal of new upward movement in the market dynamics proving the existence of stable demand. Due to this, Dogecoin was able to stay above the support levels in the short term and demonstrate resilience even to short-term pullbacks.

DOGE continued to accumulate its gains throughout the day, which strengthened all-day bullish trading in periods of short-term trade. The trend was that of contained volatility and undoubted salvaging of prior price convergence. Thus, the session ended with a strong performance of market stability.

Greater Performance Trends Help in slowing betterment.

The broader information proved that the upward trend was not limited to daily trends, indicating further recovery in various periods. In the last one week, DOGE has gained 4.68 percent and has regained some of its monthly fall. Nevertheless, the coin is 37.43% down on the year-to-date, that is, the coin is on a longer correction cycle even though there are short-term gains.

Source: TradingView

This renewed bullish momentum followed sustained support observed over a six-month period, during which DOGE climbed 8.43%. The consistent improvement suggests periodic recovery phases rather than temporary spikes. Moreover, a 41.10% annual gain underscored the coin’s capacity to rebound under improving conditions.

All in all, the data was indicative of further bullish movement through technical strength and stable demand of a recovering market. The long-term performance of Dogecoin exemplified a capability of remaining in recovery amidst wider performance of digital assets. Thus, the future is still bright with the interest in buying being steady.

Outlook Points Toward Sustained Market Strength

Dogecoin’s recent rebound reaffirmed bullish momentum across short and medium-term ranges. Its controlled upward movement suggested confidence within the current trading framework. Furthermore, the coin’s steady consolidation above $0.19 reinforced a positive technical setup.

As bullish momentum persists, DOGE continues to build strength through consistent market activity and reduced downside pressure. Each upward move supports the development of a more stable price base. Consequently, this sustained trend strengthens expectations for continued performance improvement.

In conclusion, the market trend highlights enduring bullish momentum supported by favorable structural indicators. Dogecoin maintains a stable position in the broader crypto environment with measured growth potential. Hence, continued buying activity could extend the current upward trajectory in the coming sessions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.