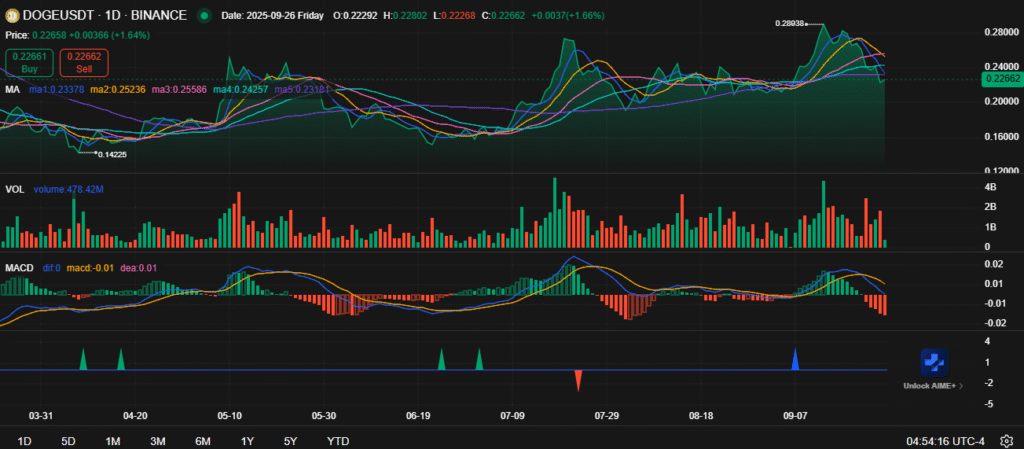

- Dogecoin margin above this will keep the bullish potential alive, but a loss will lead to further losses towards a possible breakdown at $0.20.

- Sellers have been holding this zone, however, breaking out of it may act as an indicator of a new upward trend.

- MACD remains bearish, but selling pressure is eased, which points to potential consolidation in the next move.

Dogecoin trades near $0.2266 and maintains a key floor at $0.22. The digital asset remains steady despite recent selling pressure. Market participants recognize $0.22 as a turning point and continue to monitor its ability to sustain higher price action.

The ascending structure highlights consistent higher lows and points toward consolidation. Sellers hold resistance near $0.29, creating a clear barrier that halts upside momentum. Price action within the triangle suggests a possible breakout if support remains firm and volume strengthens in the coming sessions.

Failure to defend $0.22 could trigger further decline toward lower retracement levels. A breach of support would expose $0.20 and $0.19 zones. Sustained buying interest, however, increases the probability of a rebound back toward the $0.29 threshold.

Price Action and Moving Averages

Dogecoin trades below most short and mid-term moving averages, including MA10 and MA20. Sellers remain in control as momentum weakens above $0.24. The MA120 near $0.2318 offers additional long-term support and signals resilience despite short-term downside pressure.

Source: chart.ainvest

The price must reclaim the $0.24 to $0.25 range for bullish strength to return. Sustained trade above this zone could confirm momentum. Conversely, inability to recover above moving averages may extend consolidation around current levels.

The recent trend shows a clear phase of adjustment after the $0.28 peak. Short-term traders see narrowing ranges with limited direction. Longer-term structures still favor potential continuation if DOGE maintains its base.

Market Indicators and Outlook

Volume activity remains moderate, highlighting reduced strength compared to the earlier rally toward $0.289. Buying attempts emerge but lack conviction in recent sessions. Stronger inflows are required to validate a push toward higher resistance.

MACD indicators currently display negative territory with the signal line crossing downward. Selling momentum dominates, though histogram readings suggest easing bearish pressure. This setup hints at possible stabilization before renewed direction.

Dogecoin remains in consolidation with $0.22 acting as the critical line. Holding this base could open pathways toward $0.25 and $0.29. A breakdown, however, would shift focus toward the $0.20 support range.